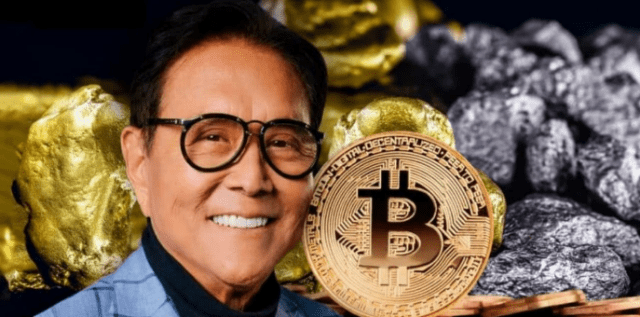

Robert Kiyosaki, author of “Rich Dad Poor Dad,” is rooting for a Bitcoin crash. He believes the recent dip isn’t a major event, but rather a buying opportunity.

Clickbait and Fear-Mongering

Kiyosaki calls out what he sees as clickbait headlines warning of an imminent Bitcoin collapse. He argues that these articles are designed to scare off investors and create short-term selling pressure. He views this fear-mongering as counterproductive for long-term holders.

Kiyosaki’s own strategy? He’s hoping for a crash so he can buy more Bitcoin at a lower price. He’s already added to his holdings this week, purchasing Bitcoin above $100,000.

Kiyosaki’s Bullish Predictions

Kiyosaki is incredibly bullish on Bitcoin. He predicts Bitcoin will reach $180,000 to $200,000 by the end of the year and potentially $1 million within the next five years. He considers a price drop a chance to increase his holdings, viewing Bitcoin as a major investment opportunity alongside gold and silver.

A Different Perspective

Not everyone shares Kiyosaki’s optimism. Some analysts point out that a 10% pullback from recent highs isn’t unusual for Bitcoin. They highlight the volatility of the market and the potential for further price drops if retail investors panic and sell.

Long-Term Vision

Kiyosaki’s view aligns with other long-term Bitcoin holders like Michael Saylor, who emphasizes the potential for significant gains for those holding Bitcoin for five years or more. This long-term perspective is based on Bitcoin’s limited supply and increasing global demand.

The Bottom Line

Kiyosaki’s message is simple: don’t let fear-driven headlines dictate your investment decisions. If you believe in Bitcoin’s long-term potential, a dip could be a good time to buy. However, this strategy involves risk and requires careful consideration of your own risk tolerance and financial situation.