Justin Sun, the founder of Tron, has been making headlines for his recent Ethereum (ETH) purchases. He’s not just dipping his toes in either; he’s splashed a whopping $5 million on the second-largest cryptocurrency.

Sun’s Ethereum Spree

According to on-chain analytics, Sun has been steadily accumulating ETH since February. He’s reportedly bought over 360,000 ETH tokens, spending over $1 billion in the process. His latest purchase of 1,614 ETH was made through three different wallets.

What’s even more interesting is that Sun recently deposited a hefty $45 million worth of USDT (a stablecoin) into Binance, a major crypto exchange. This suggests he might be planning even more ETH purchases in the near future.

Riding the ETF Wave

Sun’s big ETH bet comes at a time when everyone’s talking about Spot Ethereum ETFs. These are funds that allow investors to buy and sell ETH directly, just like traditional stocks. The US Securities and Exchange Commission (SEC) has hinted that these ETFs could launch soon, and the crypto market is buzzing with excitement.

Some believe that the launch of Spot Ethereum ETFs could trigger a major rally for ETH, pushing its price higher. Sun might be hoping to capitalize on this potential surge by buying up ETH before the ETFs hit the market.

Whales Are Back

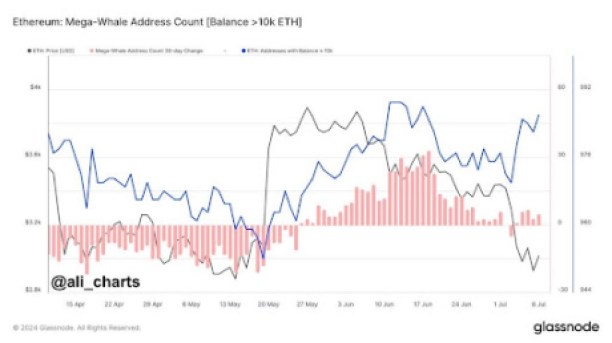

While Ethereum has been experiencing some recent price dips, there’s a growing sense of optimism. Analysts are noticing that Ethereum whales (investors with large amounts of ETH) are starting to accumulate the cryptocurrency again.

This could be a sign that they believe ETH is poised for a rebound.

What’s Next for ETH?

Despite the current excitement, some analysts are predicting that ETH could see further price declines in the short term, especially after the launch of Spot Ethereum ETFs. However, as demand for these ETFs grows and market conditions stabilize, ETH could potentially reach new heights, possibly even hitting $8,000 this year.

It’s a risky bet, but Justin Sun seems confident that Ethereum is a winning horse. Only time will tell if he’s right.