Social media is buzzing with talk of buying Bitcoin after its recent price drop. Let’s dive into the details.

Social Sentiment and Bitcoin

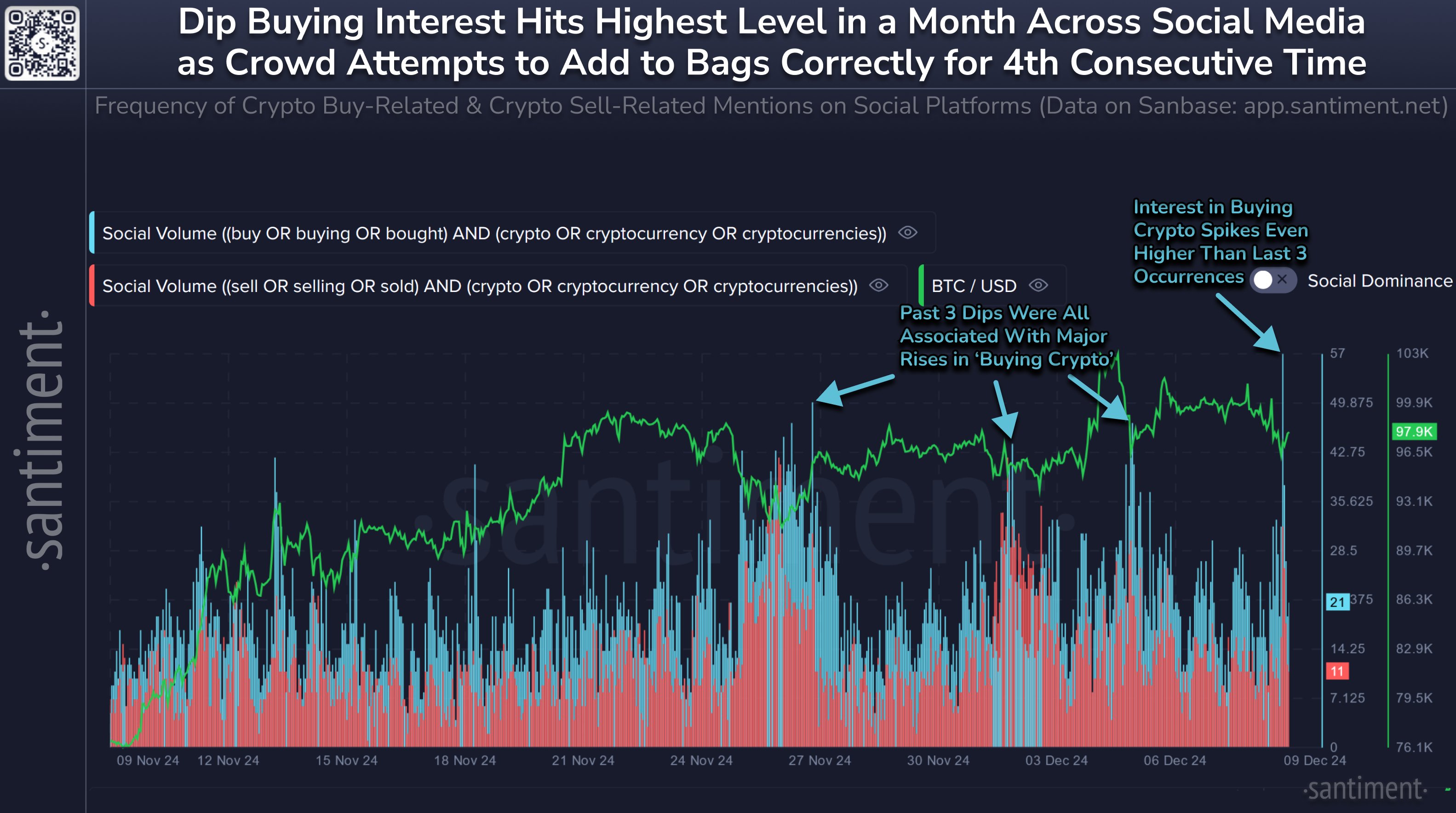

A cryptocurrency analytics firm, Santiment, analyzed social media chatter following the latest Bitcoin price dip. They looked at “Social Volume,” which basically measures how much people are talking about Bitcoin on platforms like X (formerly Twitter). Instead of counting individual mentions (to avoid skewed results from viral posts), they counted the number of posts mentioning Bitcoin.

To gauge investor sentiment, Santiment filtered this data, focusing on posts containing words related to “buying” and “selling.”

The Buying Frenzy

The chart Santiment shared shows a significant spike in posts mentioning buying Bitcoin after the recent price drop. Conversely, mentions of selling remained low. This suggests many people see the dip as a chance to buy more.

This isn’t the first time this has happened. Over the past month, there have been four similar spikes in “buy” mentions following Bitcoin price declines. Interestingly, these buying sprees have historically been followed by price increases, unlike the usual “Fear Of Missing Out” (FOMO) that often leads to price peaks. The key difference seems to be that these buying signals appeared after

What This Means

The current spike in “buy” mentions might lead to another price increase, mirroring past trends. However, it’s important to remember that intense market excitement and a renewed Bitcoin uptrend could still trigger the negative effects of FOMO. So, it’s worth keeping an eye on social sentiment.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $96,900, showing a more than 2% increase over the past week.