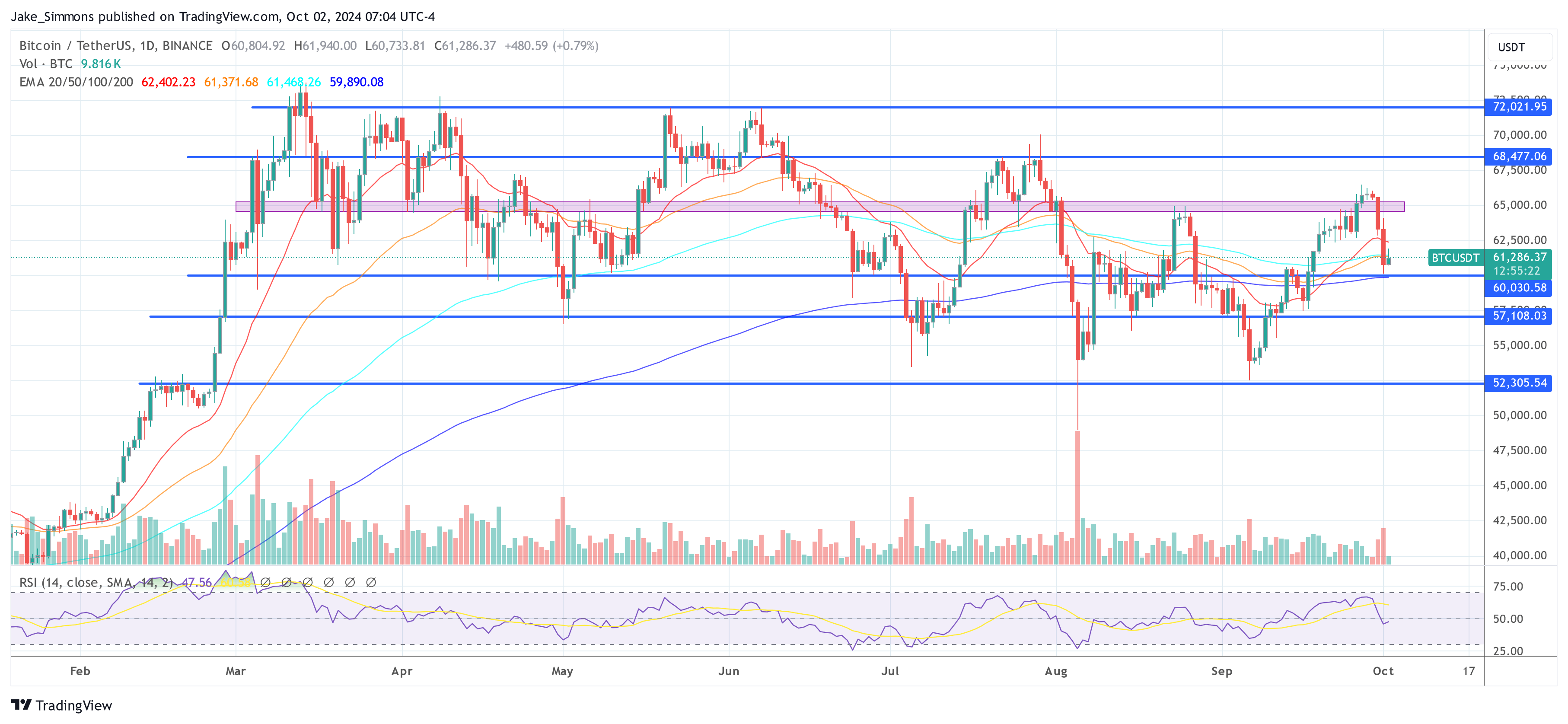

The price of Bitcoin took a tumble recently, dropping to $60,164 after Iran launched missile attacks on Israel. This heightened geopolitical tension rattled global markets, including the crypto world. Bitcoin wasn’t immune, experiencing a 4% drop.

A Temporary Dip or a Bigger Trend?

While many analysts were predicting a strong bullish month for Bitcoin, this news shifted the market sentiment towards risk aversion. However, some analysts believe the reaction might be overblown.

Alex Krüger, a macro strategist, points out the volatility of financial markets during US election years. He expects further uncertainty and volatility leading up to the elections and upcoming payroll data.

CRG, a prominent crypto analyst, believes the dip could be temporary. He notes that the market often puts in highs and lows early in the trading period, and geopolitical events tend to be faded quickly. He remains bullish on Bitcoin’s long-term trajectory, predicting a price of $100,000.

A Wider Perspective

QCP Capital, a Singapore-based trading firm, also weighed in on the situation. They observed that while the traditional financial markets reacted relatively calmly to the conflict, the crypto market saw a sharper decline.

However, QCP Capital remains optimistic about the broader economic outlook. They believe the global monetary policies, including the potential for fiscal support in China, will likely support asset prices, including crypto.

Overall, while the Israel-Iran conflict has caused a temporary dip in Bitcoin’s price, many analysts believe the long-term outlook for Bitcoin remains positive.