Bitcoin’s price has been a bit wobbly lately. After hitting a record high of $108,135, it’s struggled to stay above $100,000 for any length of time. This has some people wondering if the bull market is over. But a closer look at the data suggests otherwise.

What Short-Term Holders Are Telling Us

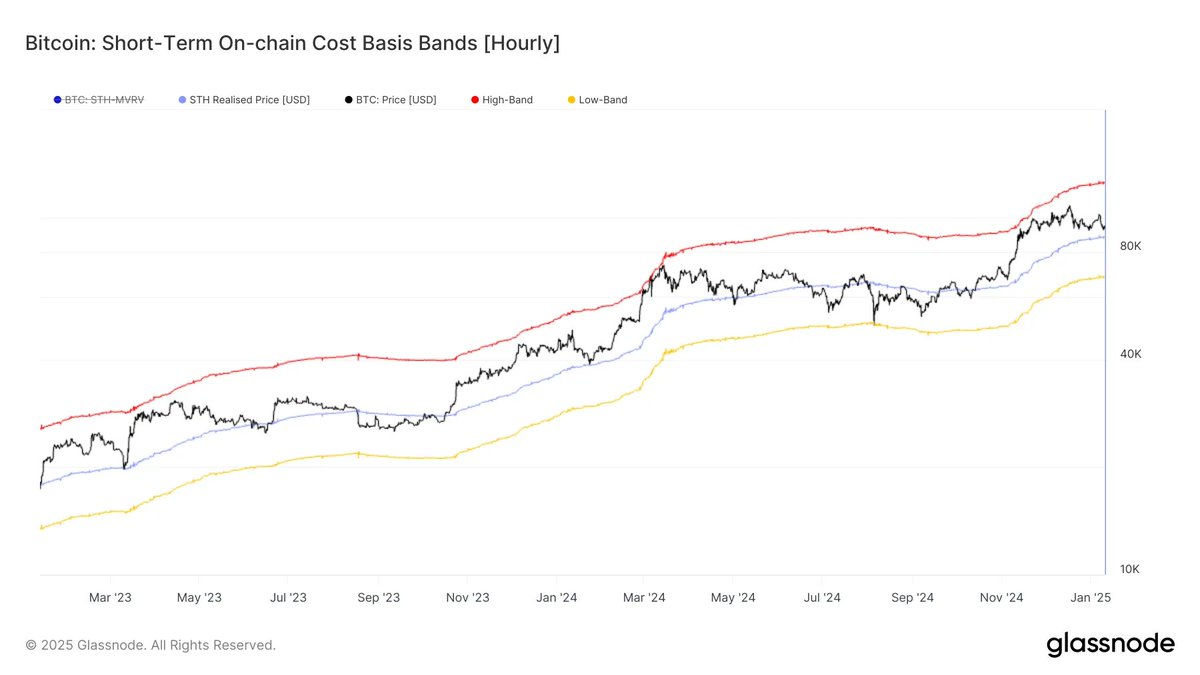

Blockchain analytics firm Glassnode looked at the average price short-term Bitcoin holders (those holding for less than 155 days) paid for their coins. This “cost basis” is a good indicator of market sentiment.

During bull markets, Bitcoin’s price usually stays above the short-term holders’ cost basis. This shows strong buying interest. If the price falls below it, newer investors are losing money, often leading to more selling.

Currently, Bitcoin’s price is about 7% above the short-term holder cost basis (around $88,135). This suggests short-term holders aren’t likely to sell just yet. If the price stays above this level, the bull market could continue. A drop below $88,000, however, could signal a shift to a bear market.

A Market Bounce Back?

The crypto market has been pretty gloomy recently, with many coins dropping significantly. Social media is full of traders talking about selling. Interestingly, this negative sentiment might actually increase the chances of a price recovery. Santiment, another on-chain data firm, noticed this pattern in late 2024: increased bearish talk was followed by higher prices. So, the current negativity could be a sign that a rebound is on the horizon./p>