Bitcoin’s Active Addresses Are Falling

A recent trend in Bitcoin’s active addresses is causing some concern. Active addresses refer to unique addresses that participate in transactions on the Bitcoin network. These addresses are like the unique users visiting the network, so a decline in active addresses means less activity.

Since March, the number of active Bitcoin addresses has been steadily decreasing. This decline is particularly significant because it’s happening after Bitcoin reached a new all-time high. The drop is even more pronounced than the decline seen during the 2022 bear market.

What Does This Mean for Bitcoin?

A decline in active addresses could be a bearish sign for Bitcoin. Bitcoin needs active users to sustain a rally. The drop in active addresses could indicate that investors are losing interest in Bitcoin.

But Wait, There’s More!

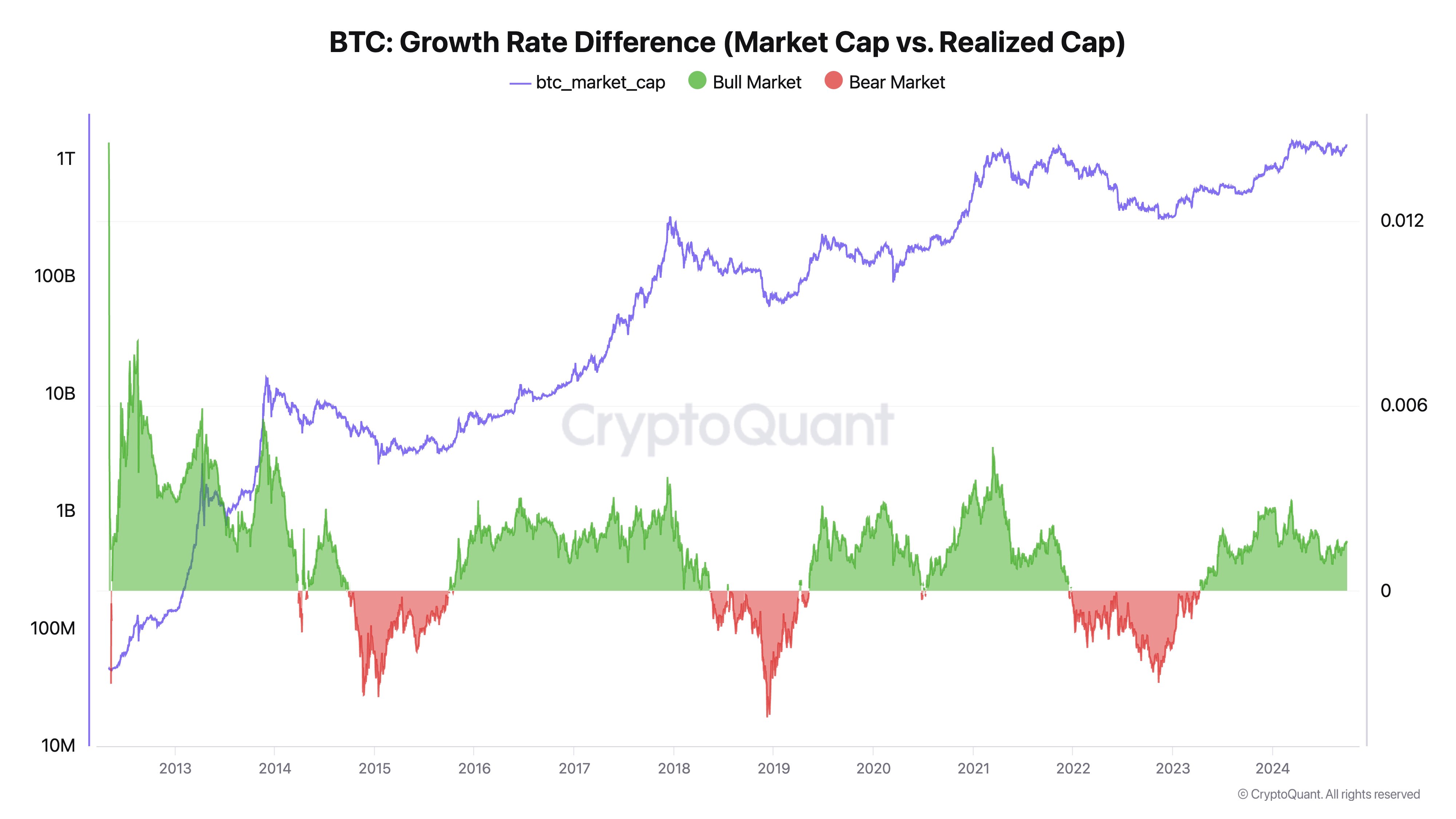

While the active address trend is concerning, other indicators suggest that Bitcoin might still be in a bull market. One indicator, the Bitcoin Growth Rate Difference, compares the growth of Bitcoin’s market cap to its realized cap. The realized cap is a measure of the total capital invested in Bitcoin. Currently, the market cap is growing faster than the realized cap, which is a sign of a bull market.

So, What’s the Verdict?

It’s still too early to say for sure whether the Bitcoin bull run is over. The decline in active addresses is a cause for concern, but other indicators suggest that the market might still be bullish. It’s important to monitor these indicators closely to see how they develop in the coming weeks and months.