The crypto market recently took a dive, with Bitcoin, Ethereum, XRP, and Solana all seeing significant price drops. Despite the red numbers, some prominent voices in the crypto world are suggesting it might be time to get bullish on Ethereum (ETH).

A Bullish Outlook on ETH

CryptoQuant CEO, Ki Young Ju, shared his optimistic view on Ethereum, emphasizing that despite recent events like the Bybit hack, there hasn’t been a major sell-off. He pointed out that both on-chain data and market indicators remain relatively neutral. He highlighted several key points:

- Stablecoin Dominance: Ethereum’s control over the stablecoin market (around 56%) is significant.

- Regulatory Tailwinds: Potential regulatory changes under the Trump administration could boost ETH-based stablecoins and smart contracts.

- ETF Approvals: The already-approved ETH spot ETF suggests a potential “large-cap ETF altseason” is on the horizon. BlackRock’s ETH spot ETF holdings have even increased by a massive 124% in the last three months!

- Whale Accumulation:

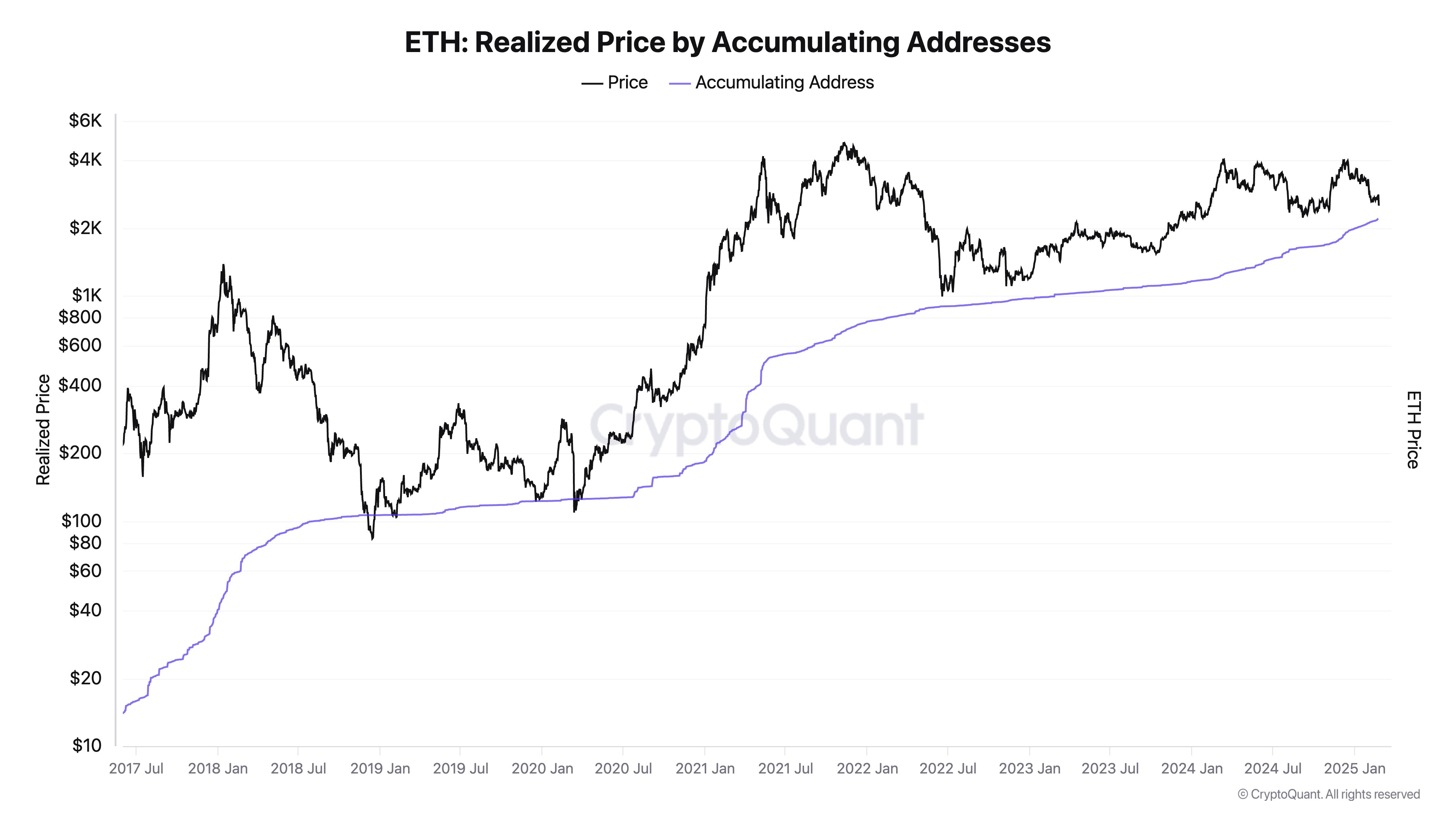

Large Ethereum holders (those with 10,000 to 100,000 ETH) have increased their holdings by 24% over the past year, suggesting accumulation near their cost basis.

Large Ethereum holders (those with 10,000 to 100,000 ETH) have increased their holdings by 24% over the past year, suggesting accumulation near their cost basis.

Ju did express surprise at the overwhelmingly bearish sentiment on Crypto Twitter, questioning the data behind the negativity.

More Voices Joining the Chorus

Ju isn’t alone in his bullish stance. Other prominent figures are echoing similar sentiments:

- AdrianoFeria.eth: This community member highlighted positive institutional and political signals, including reports of the US President and family purchasing significant amounts of ETH, BlackRock’s support for tokenization, and Bybit’s need to buy ETH to cover its hack. He also noted that Citadel CEO Ken Griffin believes Ethereum could surpass Bitcoin. The overwhelmingly negative sentiment on Crypto Twitter only strengthens his contrarian bullish view.

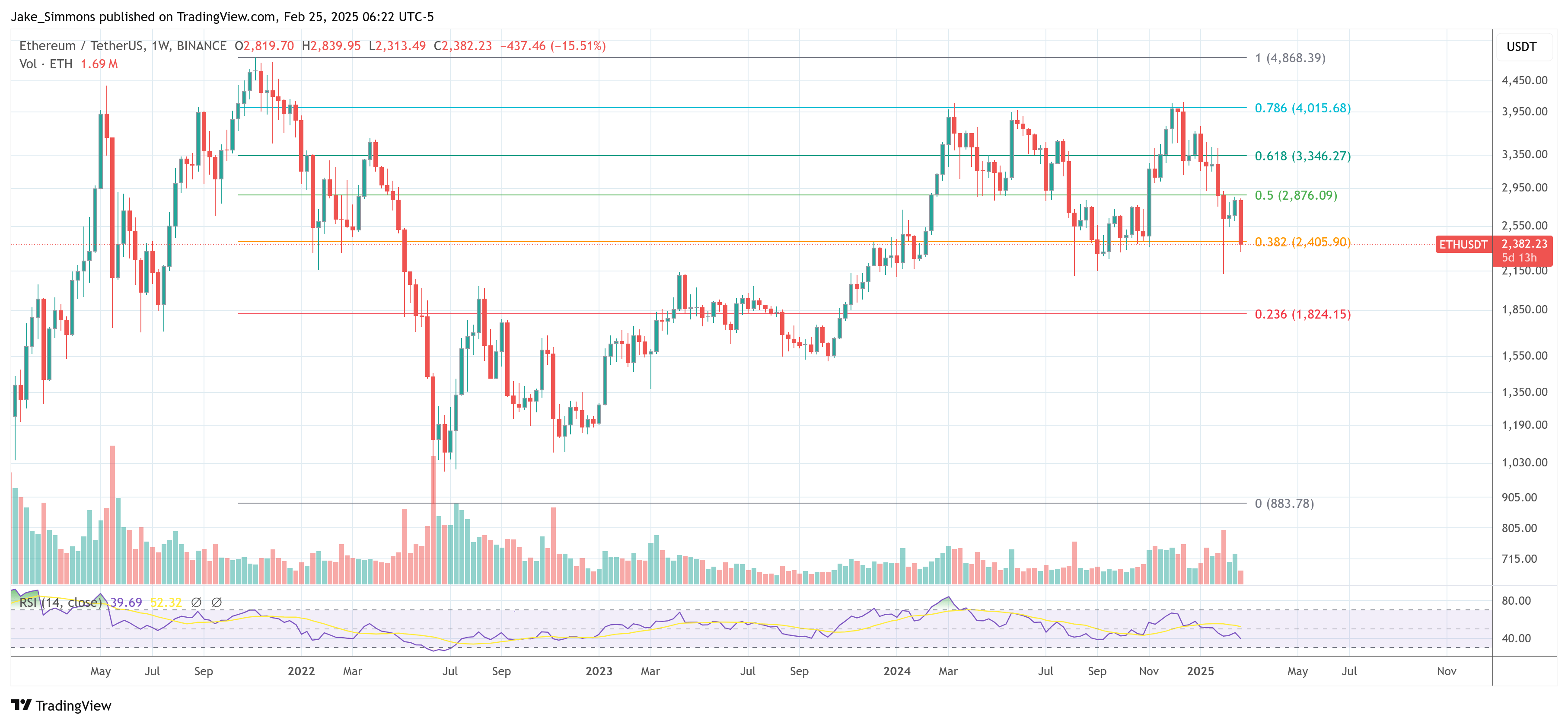

- IncomeSharks: This crypto analyst pointed to a chart showing a potential buy zone above $2,400.

- Chris Burniske (Placeholder VC): He offered historical context, reminding everyone of similar mid-cycle drawdowns in 2021, suggesting the current situation isn’t unprecedented.

In short, while the market is currently down, several influential figures believe the long-term outlook for Ethereum remains positive. They point to various factors, from regulatory changes to institutional investment and whale accumulation, as reasons to remain optimistic. At the time of writing, ETH was trading around $2,382.