Ethereum, once known for its deflationary supply, is facing new challenges that are making some people question its future.

Ethereum’s Inflation Problem

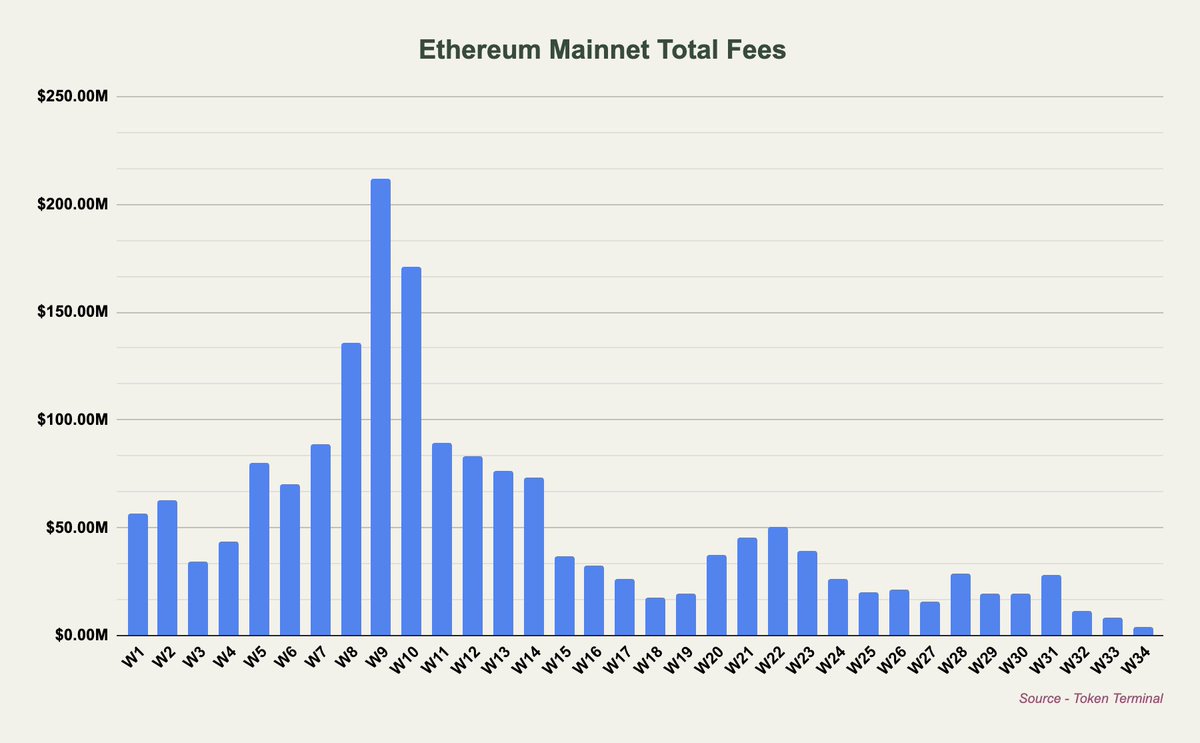

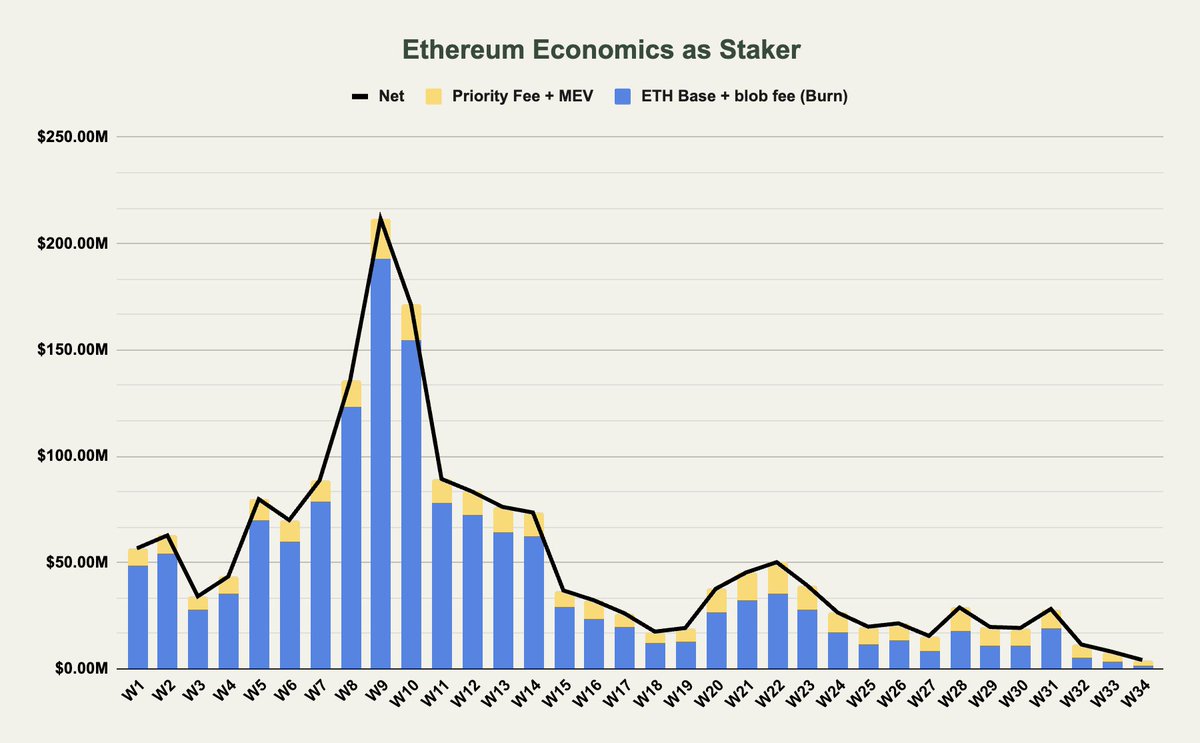

A crypto analyst, Thor Hartvigsen, recently pointed out that Ethereum’s fee generation has been declining, especially since the introduction of “blobs” in March. Blobs allow Layer 2 (L2) solutions to bypass paying high fees to Ethereum, shifting activity away from the main network. This has resulted in Ethereum becoming slightly inflationary, with a yearly inflation rate of around 0.7%.

Impact on Non-Stakers and Stakers

This inflation affects different groups differently:

- Non-stakers: They used to benefit from Ethereum’s burn mechanism, which reduced the overall supply of ETH. However, with lower fees and blobs, they are seeing less benefit from this burn.

- Stakers:

They capture all fees, either through the burn or staking rewards. However, they’ve also seen a significant drop in fees, raising concerns about the sustainability of Ethereum’s “ultra-sound money” narrative.

Ethereum’s Future

Hartvigsen believes that Ethereum’s ultra-sound money narrative is no longer valid. He argues that Ethereum is now more similar to other Layer 1 blockchains like Solana and Avalanche, which also face inflationary pressures.

One potential solution is to increase the fees that L2s pay to Ethereum, but this could make Ethereum less competitive.

Ultimately, Ethereum, like other infrastructure layers, needs to find a new way to maintain its value proposition.