Ethereum’s recent price drop has sparked a debate among crypto analysts. Some believe it’s a great buying opportunity, while others remain cautious. Let’s dive into their perspectives.

The Bullish Case for ETH

Several analysts, including Doctor Profit (who accurately predicted the drop), now see Ethereum as undervalued. They point to the $1,800 support level as a historical bottom, suggesting a potential rebound. The fact that this level held, coupled with large investors (“whales”) accumulating more ETH, strengthens this bullish outlook. One analyst, Astronomer, even predicts a return to $4,000. They highlight technical indicators and the historical significance of the $1,800 support as reasons for their optimism.

The Bearish Counterpoint

Not everyone is convinced. Analyst Kledji suggests a further drop to $1,400 is possible before any significant recovery. He ties this prediction to Bitcoin’s performance, implying that if Bitcoin doesn’t recover, Ethereum could fall further.

Historical Trends and Market Dominance

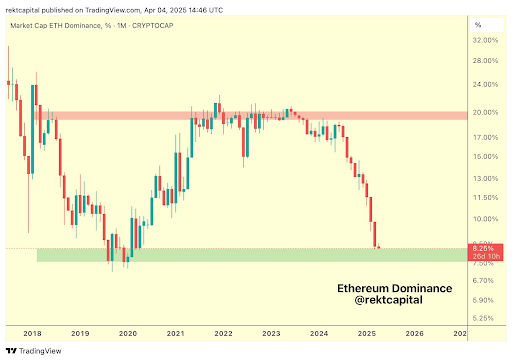

Analyst Rekt Capital points to Ethereum’s declining market dominance, dropping from 20% to 8% since June. However, he notes that historically, Ethereum has rebounded strongly from similar lows, suggesting a potential for a significant recovery and increased market share.

A Very Bullish Prediction

Crypto Patel offers the most bullish prediction, suggesting a potential surge to $6,800 (a new all-time high) based on his Wyckoff chart analysis. This would involve ETH bouncing off the $1,800 support.

Current Price and Conclusion

At the time of writing, Ethereum is trading around $1,800, showing a slight increase over the past 24 hours. The analysts’ opinions vary widely, highlighting the inherent uncertainty in the crypto market. Whether you choose to buy or wait depends on your risk tolerance and investment strategy.