A recent report by Joe Consorti, Head of Growth at Theya, debunks claims that Bitcoin’s price is artificially suppressed. Consorti’s analysis focuses on on-chain data, revealing a more natural explanation for Bitcoin’s current price behavior.

The “Boring” Consolidation Period

The idea that Bitcoin’s relatively stable price is the result of manipulation is a common argument. However, Consorti argues that this is easily disproven. Bitcoin’s transparent blockchain allows anyone to see who’s buying and selling, making any large-scale manipulation readily apparent.

Instead, the data shows a typical pattern: long-term holders (LTHs) are selling off some of their Bitcoin after accumulating it at lower prices ($15,000-$25,000), passing it on to new buyers who push the price higher. This happened repeatedly at various price points, and it’s happening again now. Consorti notes that LTHs are starting to accumulate again, a sign that another price breakout might be near.

External Factors and Bitcoin’s Strength

Consorti points to several external factors influencing Bitcoin’s price:

- A major Ethereum hack: While this caused a temporary dip, Bitcoin’s resilience (only a 1.75% drop) demonstrates its strength and decreasing correlation with other cryptocurrencies.

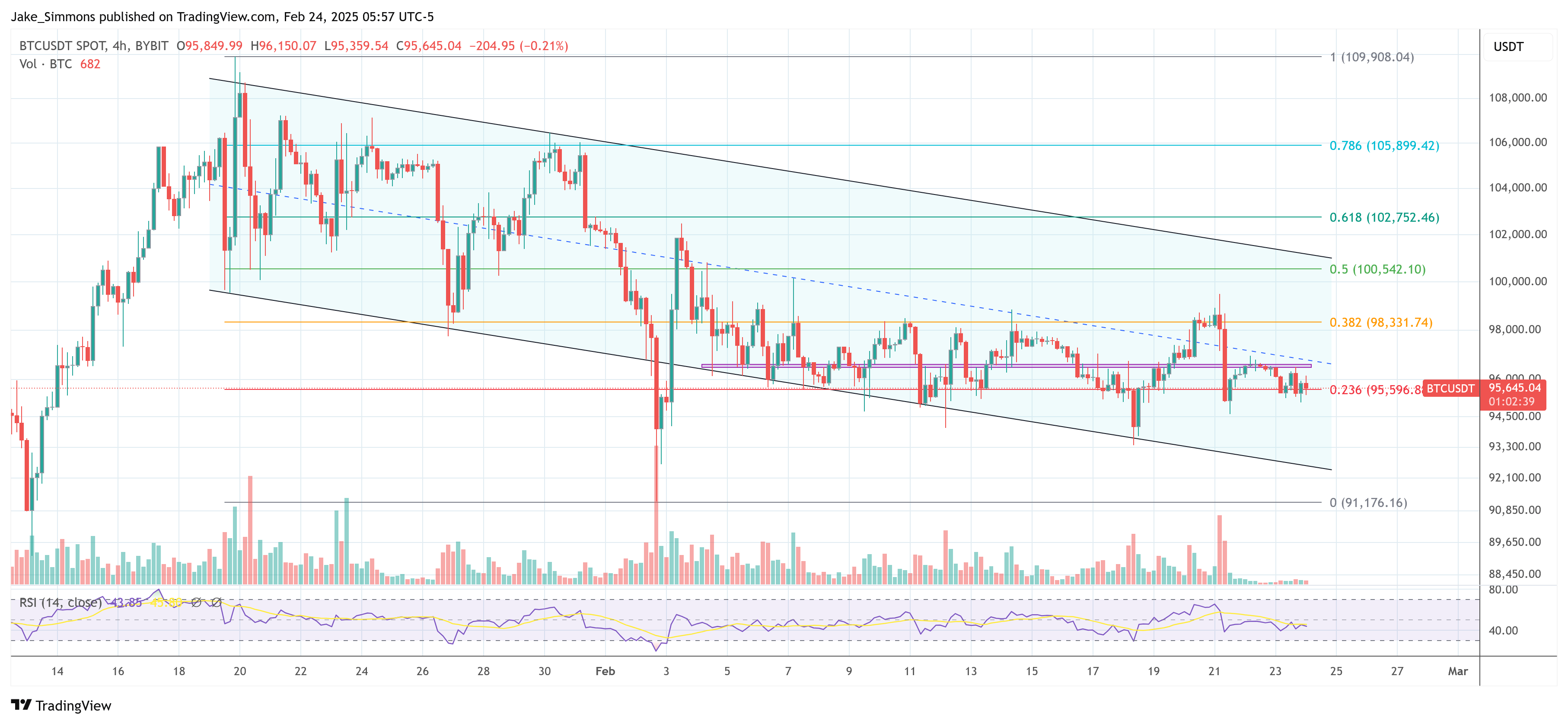

- Falling wedge pattern: Consorti predicts this pattern will resolve by early March, leading to a price increase, unless unforeseen events occur. He acknowledges that the consolidation period could last longer, potentially mirroring last summer’s extended period.

- President Trump’s Bitcoin working group:

The group’s decision on a potential Strategic Bitcoin Reserve could significantly impact the market, either positively or negatively.

The group’s decision on a potential Strategic Bitcoin Reserve could significantly impact the market, either positively or negatively. - Decreased ETF inflows: While still substantial, daily inflows into Bitcoin ETFs have decreased, suggesting other factors are now more influential on price.

Macroeconomic Factors and Bitcoin’s Future

Consorti’s analysis also considers macroeconomic factors:

- Bitcoin’s decoupling from M2: The correlation between Bitcoin’s price and the global M2 money supply has broken down, but with M2 rising again, a renewed correlation could drive Bitcoin higher.

- Gold price correlation: A comparison with gold suggests a potential upward trend for Bitcoin, possibly pushing it towards $120,000.

- US Treasury (UST) demand: Decreasing foreign demand for USTs, coupled with the increasing role of stablecoins, is creating a new dynamic in the Treasury market. Stablecoins, holding significant Treasury reserves, are effectively acting as a new foreign central bank, ensuring demand and potentially lowering long-term interest rates.

Conclusion

Consorti’s research suggests that Bitcoin’s current price behavior is largely explained by normal market dynamics and isn’t the result of manipulation. While external factors will play a role, the overall outlook, based on on-chain data and macroeconomic trends, appears positive. The price at the time of writing was $95,645.