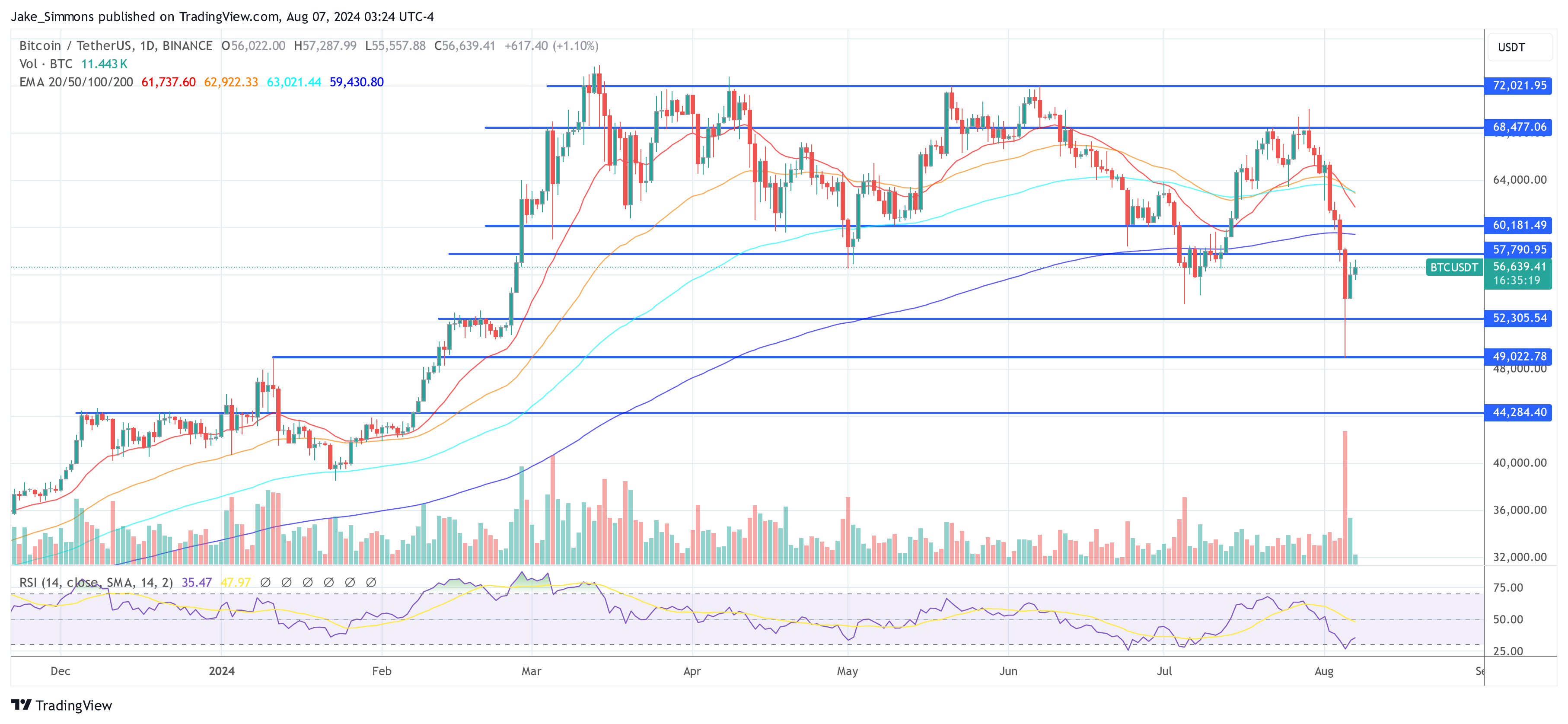

After a recent market crash, many are wondering if Bitcoin’s bull run is over. But CryptoQuant CEO Ki Young Ju thinks otherwise. He says on-chain data suggests the bull market is still alive and kicking.

Bullish Signs

Here’s what Ju sees as positive indicators:

- Mining Power is High: The Bitcoin hashrate, which measures the computing power used to mine Bitcoin, is almost at an all-time high. This means miners are still confident in Bitcoin’s future.

- Whales are Accumulating: Big investors, known as “whales,” are buying up Bitcoin. This is a good sign, as it shows they believe in the long-term value of Bitcoin.

- Retail Investors are Quiet: Retail investors, who often cause price swings, are currently staying out of the market. This could mean less volatility in the short term.

- Old Whales are Holding: Bitcoin holders who have been in the game for years aren’t selling their coins. This shows confidence in Bitcoin’s long-term potential.

Potential Red Flags

While the overall picture looks good, Ju also acknowledges some potential downsides:

- Macroeconomic Risks:

Global economic issues could cause investors to sell their Bitcoin holdings.

Global economic issues could cause investors to sell their Bitcoin holdings. - Some On-Chain Indicators are Bearish: While these indicators are not conclusive, they could signal a potential downturn if they continue for a longer period.

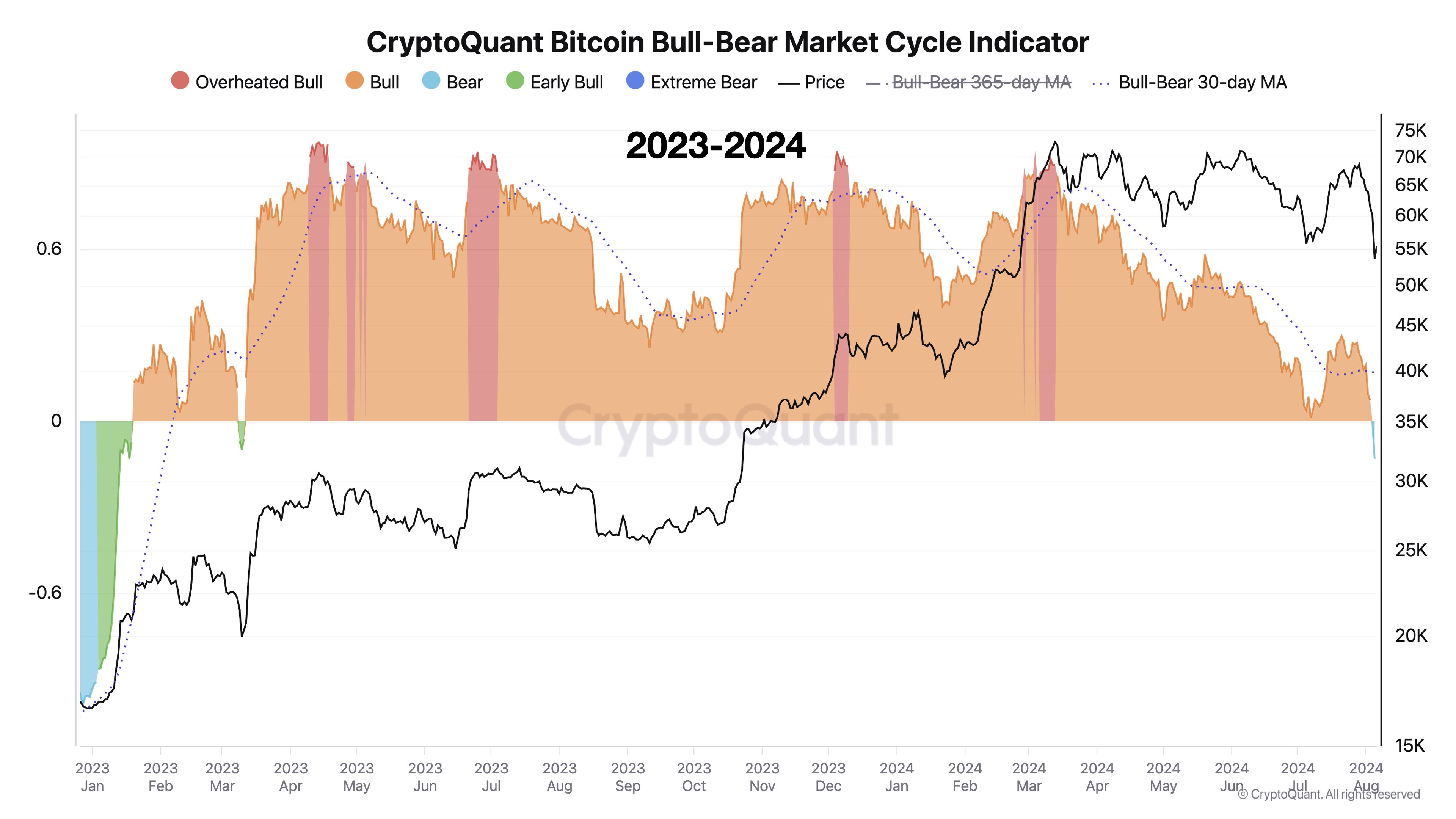

- Bull-Bear Market Cycle Indicator:

This indicator has recently flagged a bear phase, which has happened before during significant market events.

This indicator has recently flagged a bear phase, which has happened before during significant market events.

The Bottom Line

Despite these bearish signals, Ju remains optimistic about Bitcoin reaching a new all-time high this year. He believes that as long as Bitcoin stays above $45,000, it could break its previous record within a year. However, he cautions that if the current bearish indicators persist for more than a month, it could signal a more significant downturn.