Bitcoin is struggling to maintain its recent gains, with experts pointing to a decline in demand as the main culprit.

Demand is Drying Up

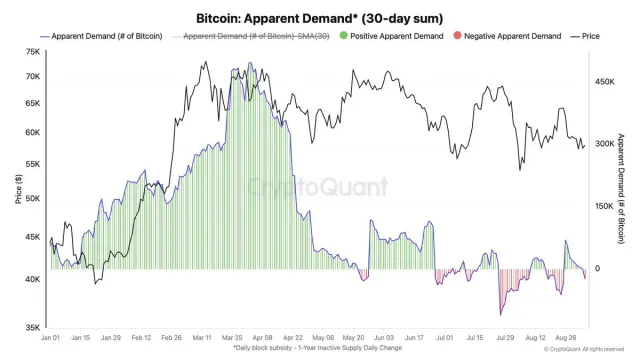

CryptoQuant’s head of research, Julio Moreno, has been tracking the situation closely. He says that various market indicators are showing a weakening demand for Bitcoin, with the 30-day sum of demand for BTC entering negative territory. This means that buyers are losing interest, which is why Bitcoin has been struggling to break out of its current price range.

Moreno says that this lack of demand has been evident since July, when Bitcoin’s demand began to decline sharply.

Key Levels to Watch

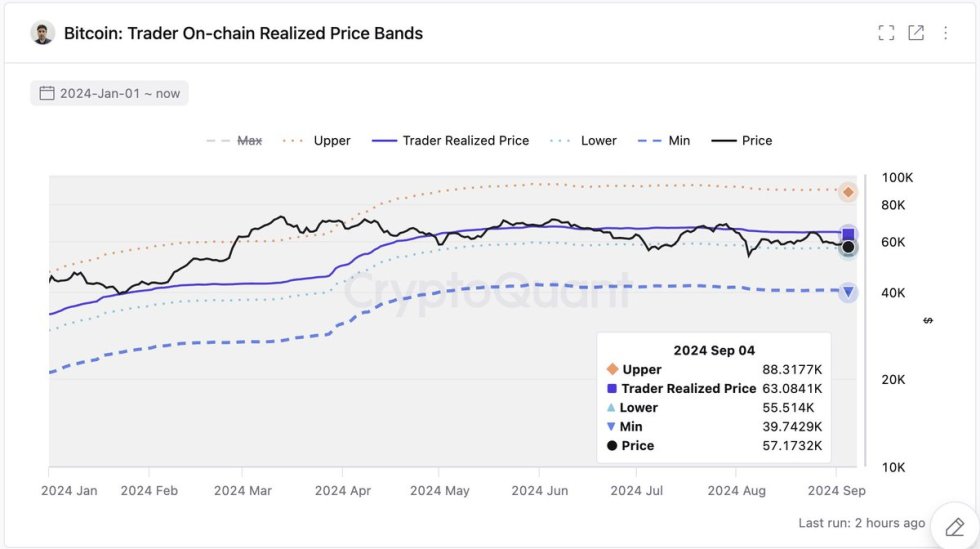

The $55,500 level is a crucial point for Bitcoin. If the price can’t reclaim this level, it suggests that the market is facing broader challenges in attracting new buyers.

Bitcoin is currently trading around $56,000, barely holding above the $55,000 level.

What’s Next for Bitcoin?

If Bitcoin can maintain its position above $55,000, it needs to reclaim the 4-hour 200 moving average, currently at $59,373, and push the price above the psychological barrier of $60,000. This would signal a renewed bullish trend.

However, if Bitcoin fails to hold the $54,500 support, a more substantial decline could be on the horizon, potentially driving the price down to $49,000 or even lower. This would signal a bearish shift and test the resilience of Bitcoin’s recent gains.

Traders are watching these key levels closely to see if Bitcoin can regain its footing or if further downside is ahead.