Bitcoin’s price has been on a tear since mid-April, soaring from under $85,000 to over $104,700. This surge was fueled by positive investor sentiment and increased investment, particularly through Bitcoin ETFs.

A Less-Than-Convincing Rally?

However, things might be cooling off. Bitcoin has struggled to break through the $102,000 – $105,000 range for the past week. This slowdown raises questions about the strength of the recent rally.

What the RSI Says

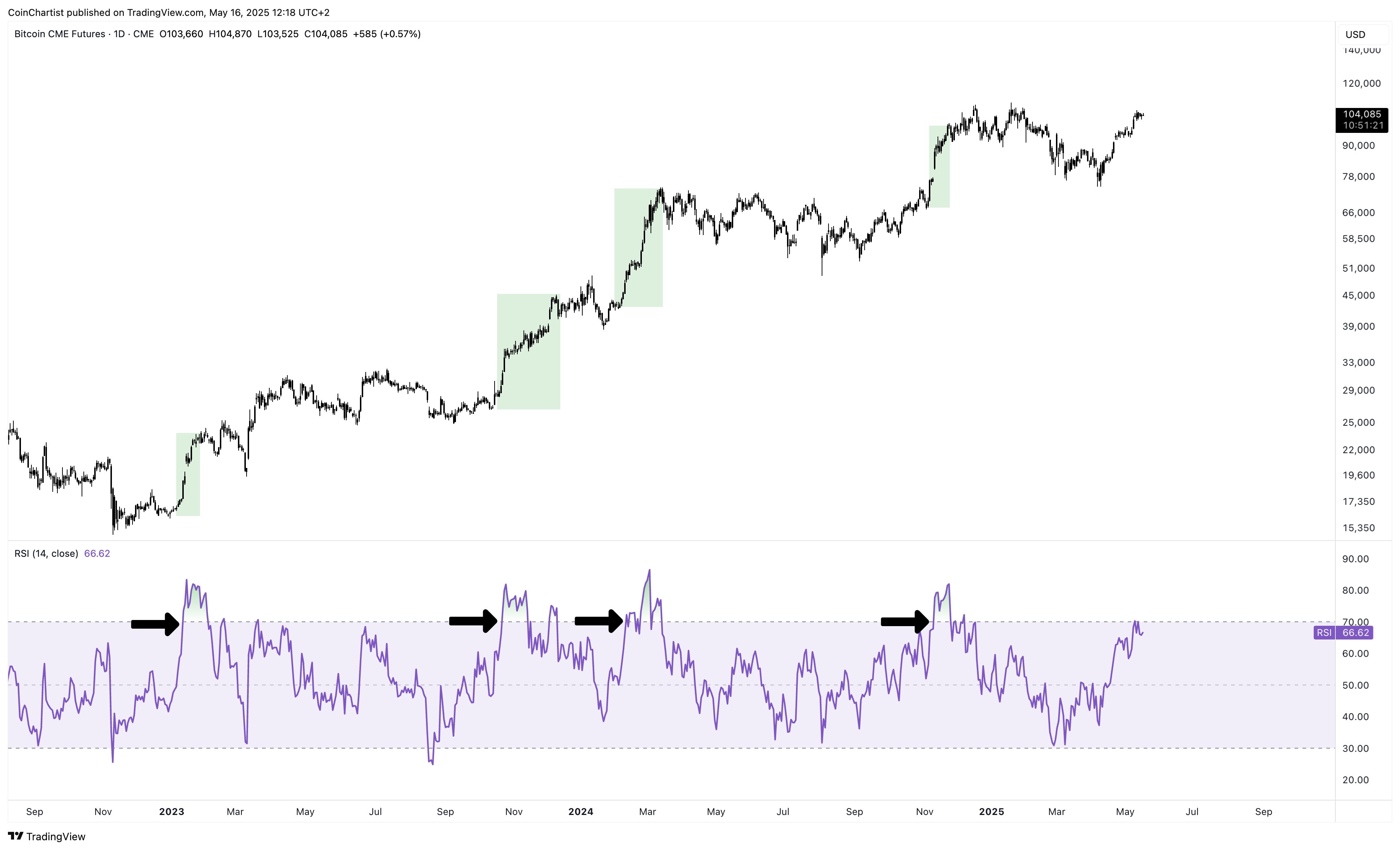

Crypto expert Tony Severino points out something interesting. Historically, strong Bitcoin bull runs are accompanied by a rapid rise in the Relative Strength Index (RSI) above 70. The RSI measures the speed and size of price changes, helping to identify overbought (above 70) or oversold (below 30) conditions. Severino notes that Bitcoin’s current price action lacks this characteristic sharp RSI increase. While the price is up, the RSI hasn’t decisively broken above 70, suggesting less aggressive buying pressure than in previous bull runs.

The Current Situation

Currently, Bitcoin is trading around $103,676, showing little movement in the last 24 hours. The past week’s gains have been modest, with only a 0.8% increase. While a strong bullish move is still possible, the lack of a clear RSI signal suggests the current rally might be less powerful than previous ones. The break above 70 RSI could still happen, potentially pushing Bitcoin towards new all-time highs.