Bitcoin’s price has cooled off a bit after a strong run, leaving it just shy of its all-time high. While the recent price action might seem typical for a weekend in the crypto world, some interesting things are happening behind the scenes.

Short-Term Holders Are Distributing

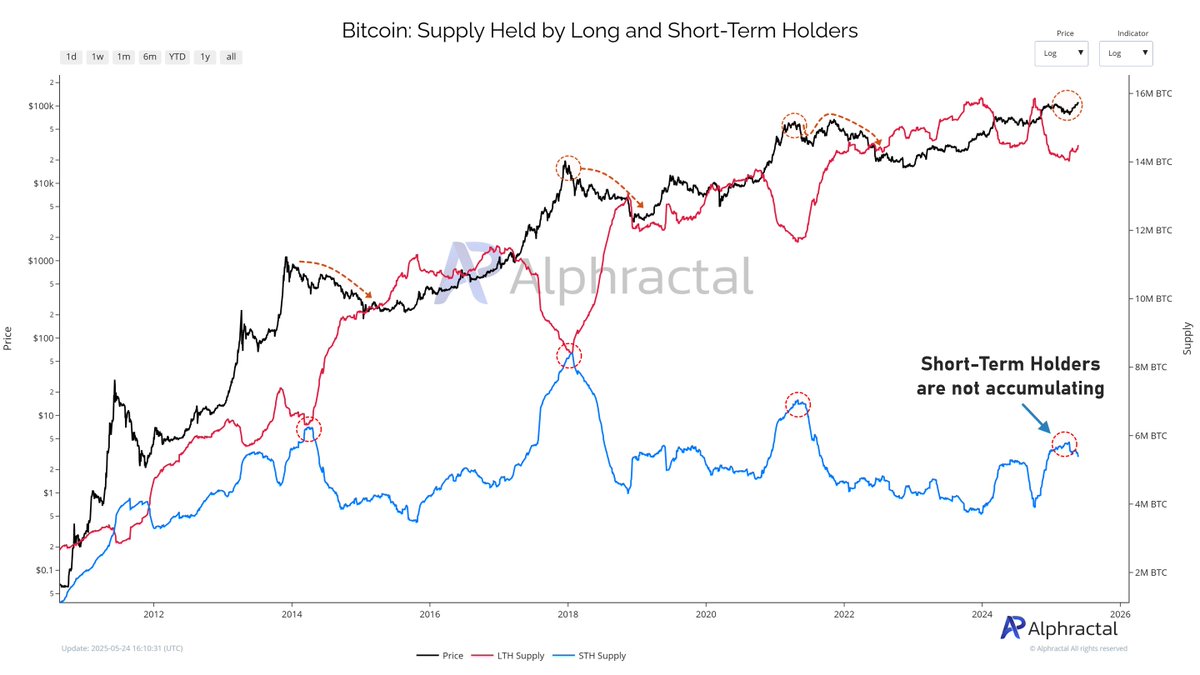

Data suggests that short-term Bitcoin holders (STHs) – those who’ve held Bitcoin for less than 155 days – are starting to sell. These investors are usually the most reactive to price changes, and this selling could be a sign that the current bull market is nearing its end.

This is based on the “Bitcoin Supply Held By Short-Term Holders” indicator, which has been dropping recently. Historically, a sharp drop in this metric often happens near major price peaks. Essentially, these reactive investors are cashing out as the price rises, reducing overall demand.

One firm, Alphractal, calls this a classic sign that the bull run might be winding down. They point out that the STH realized price (the average price at which STHs bought their Bitcoin) is around $94,500, acting as a key support level. Below that, STHs would be losing money. In contrast, long-term holders’ average buy-in price is much lower, around $33,000, showing a big difference in investor sentiment.

Will Bitcoin Crash? Maybe Not Just Yet

While the STH selling is a bearish signal, it’s not necessarily a guarantee of an immediate crash. Even in 2021, Bitcoin hit new all-time highs despite similar STH distribution. So, there’s still potential for further upside.

However, other factors, like the upcoming Bitcoin halving (expected to impact supply) and overall market trends, suggest a significant correction could start after October 2025.

Current Bitcoin Price

At the time of writing, Bitcoin is trading just under $109,000, up slightly over the past 24 hours and over 5% in the last week.