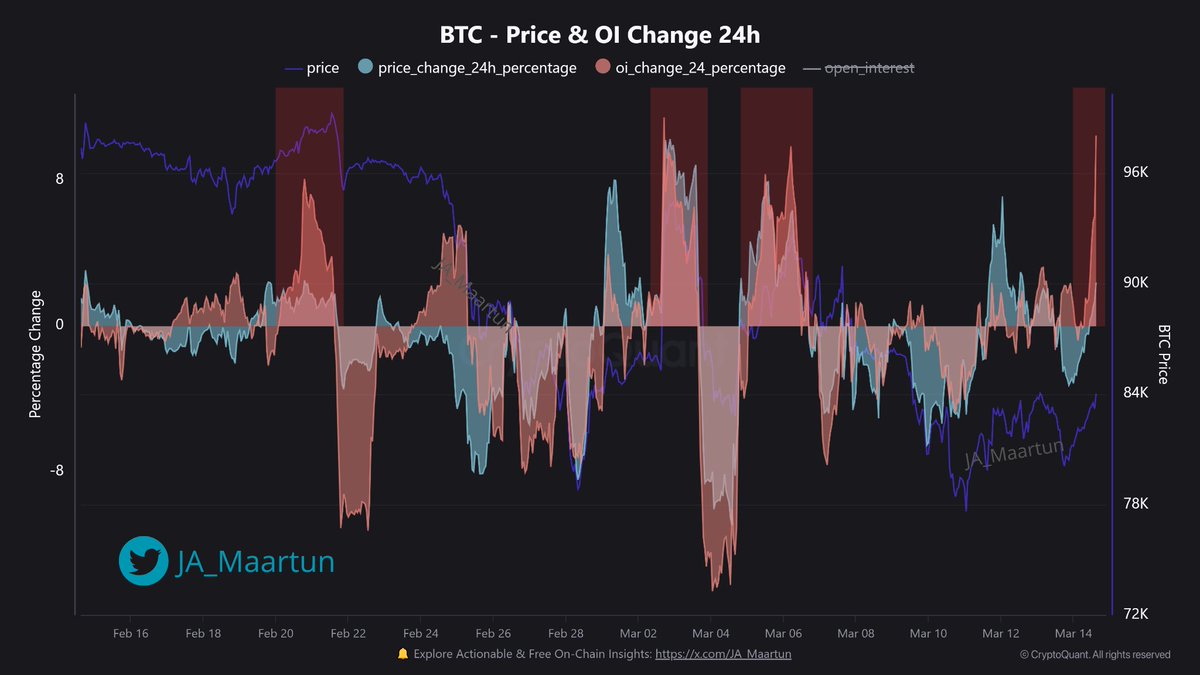

Bitcoin’s price has been a bit of a rollercoaster lately, but things seem to be looking up. After a shaky start to the week, Bitcoin showed some serious strength, briefly hitting $85,000 and closing the week strong. Interestingly, something else is also on the rise: open interest.

Open Interest: A Big Jump

Open interest (OI) is basically the total amount of money tied up in Bitcoin derivatives (like futures and options contracts). Recently, it saw a huge jump – over 13%, adding more than $3.3 billion to reach $27.9 billion. This is a pretty significant increase from its recent low.

What does this mean? A rising OI usually suggests that investors are feeling bullish and are opening new positions, betting on Bitcoin’s price going up. Conversely, a falling OI means traders are closing their positions or getting liquidated (losing their money). So, this jump in OI is generally considered a positive sign.

More Money, More Volatility?

This influx of money into the market indicates growing investor confidence (or at least speculation) about Bitcoin’s future. More investors betting on the price means more volatility – meaning the price could swing wildly up or down.

What’s Next for Bitcoin?

Some experts are predicting even bigger things for Bitcoin. One analyst suggests that Bitcoin could reach around $95,000 in the coming days, especially if it can break above its 200-day moving average. If that happens, a move towards the 50-day moving average (around the mid-$90,000 range) is possible. As of now, Bitcoin is trading around $84,500, already up almost 5% in the last 24 hours. It’s certainly an exciting time for Bitcoin investors!