Bitcoin started October with a bit of a slump, dropping over 7% in the first few days. While it bounced back a bit on Friday, investors are still feeling a bit uneasy.

Fear in the Air

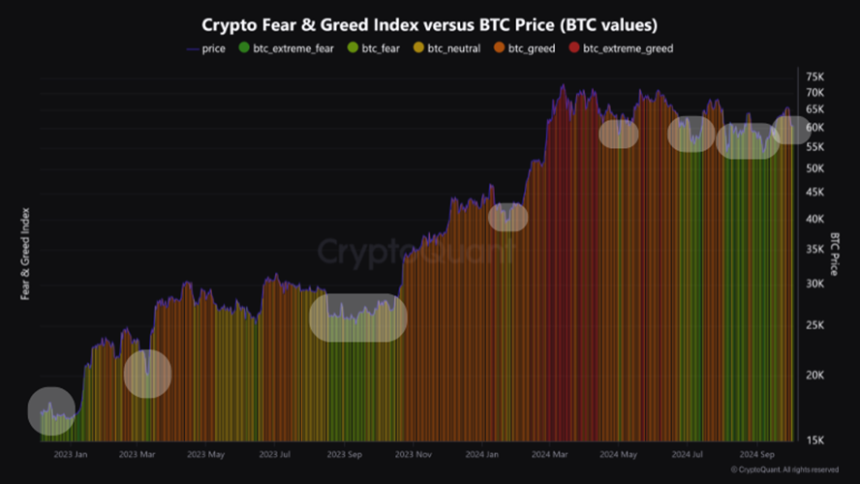

The Bitcoin Fear and Greed Index is currently sitting at 37, which means a lot of people are hesitant to buy Bitcoin right now. This index measures how optimistic or pessimistic people are about Bitcoin, and a score below 50 means fear is in the air.

Interestingly, every time the index has dipped into the “fear” zone this year, Bitcoin’s price has bottomed out and started to rise again. So, could this be another one of those moments?

A Look at the Charts

While Bitcoin did climb a bit on Friday, it’s still far from its next major support level. This means it could still fall further before it starts to bounce back.

However, October has historically been a good month for Bitcoin, with an average gain of over 22% over the past 11 years. So, maybe this dip is just a temporary setback before a big surge.

Stablecoins on the Rise

Another sign that investors are nervous is the increase in activity of stablecoins like Tether (USDT) and USD Coin (USDC). People are moving their money into these less risky assets, which suggests they’re worried about a potential Bitcoin crash.

Analysts say this fear is being fueled by a few things:

- Weak retail interest:

Not as many people are buying Bitcoin as they used to.

Not as many people are buying Bitcoin as they used to. - Geopolitical tensions: The situation in the Middle East is making people nervous.

- SEC uncertainty: The SEC hasn’t approved a Spot Ethereum ETF yet, which is making some investors hesitant.

What’s Next?

Bitcoin is currently trading around $62,000, but it’s still too early to say if it’s hit its bottom. The next few weeks will be crucial to see if the market starts to recover or if we’re in for a longer downturn.