Bitcoin’s price has been stuck in a rut lately, struggling to break back into six-figure territory. After dipping below $82,000, it tried to reach $87,000 but hit a wall. Let’s look at why $87,000 is such a key price point.

Millions of Bitcoin Holders in the Red

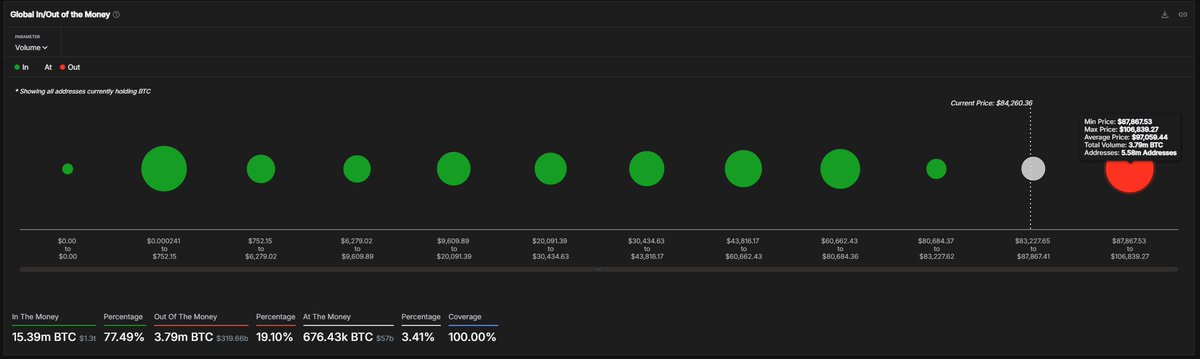

Crypto analyst Maartunn highlighted the importance of the $87,000 level. Their analysis focuses on the average cost basis of many Bitcoin investors. This means looking at how much investors paid for their Bitcoin and how that affects whether a price acts as support (holding the price up) or resistance (preventing the price from rising).

Maartunn found that around 5.58 million Bitcoin addresses bought roughly 3.79 million BTC between $87,867 and $106,839. That’s a whopping $367 billion worth of Bitcoin (at the average purchase price of $97,059)! These investors are underwater – they bought high and are now holding assets worth less than what they paid.

The $87,000 Resistance

This $87,867 – $106,839 range is a significant resistance level. If the price climbs back towards this range, these investors might panic sell to cut their losses. This selling pressure could push the price back down, preventing any further upward movement.

Making matters worse, these investors are mostly short-term holders. Short-term holders are known for reacting quickly to market changes, often leading to sharp sell-offs. If the market turns bearish again, these investors could trigger a major sell-off, potentially causing a significant price drop.

Bitcoin’s Current Situation

At the time of writing, Bitcoin is trading around $84,000, showing little change in the last 24 hours. The situation remains tense.