Bitcoin’s recent price action is hinting at some exciting possibilities. Let’s dive into the details.

Bullish Signals Abound

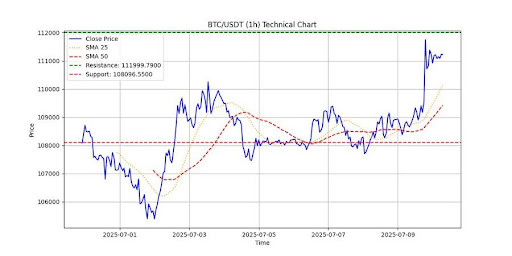

According to a recent market analysis, Bitcoin is showing some strong bullish signs. The price closed strongly above both the 25-hour and 50-hour moving averages (SMAs), suggesting a solid foundation for continued growth. This means short-term traders are likely feeling pretty confident.

Adding to the bullish picture, the Moving Average Convergence Divergence (MACD) indicator is expanding significantly. This widening gap shows strong buying pressure and reinforces the idea that the upward trend might have some legs. The Relative Strength Index (RSI) is also sitting comfortably in bullish territory (63.73), indicating healthy upward momentum without being overbought. Finally, the Average Directional Index (ADX) at 38.93 confirms the strength and durability of the current trend. All in all, the technical indicators are painting a very positive short-term outlook for Bitcoin.

A Critical Crossroads

While things look bullish, it’s not all smooth sailing. Bitcoin is approaching some crucial resistance and support levels. Resistance sits around $111,999.79, while support is at $108,096.55. These levels are key to watch, as they could determine Bitcoin’s next major move.

Interestingly, trading volume has been unusually low. This lower volume could mean increased volatility or even some “fakeouts” (false breakouts) near those key support and resistance levels. So, while the overall trend looks positive, traders should remain cautious. The low volume suggests that the market might be a bit hesitant, leading to potential surprises.

The Bottom Line

Bitcoin is currently in a potentially exciting spot. The technical indicators are overwhelmingly bullish, but low trading volume adds a note of caution. Keep a close eye on those key support and resistance levels for potential breakouts or retracements.