Bitcoin’s recent price action has some people wondering if the hype is fading. Let’s dive into some data to see what’s going on.

Bitcoin Transaction Volume Takes a Dive

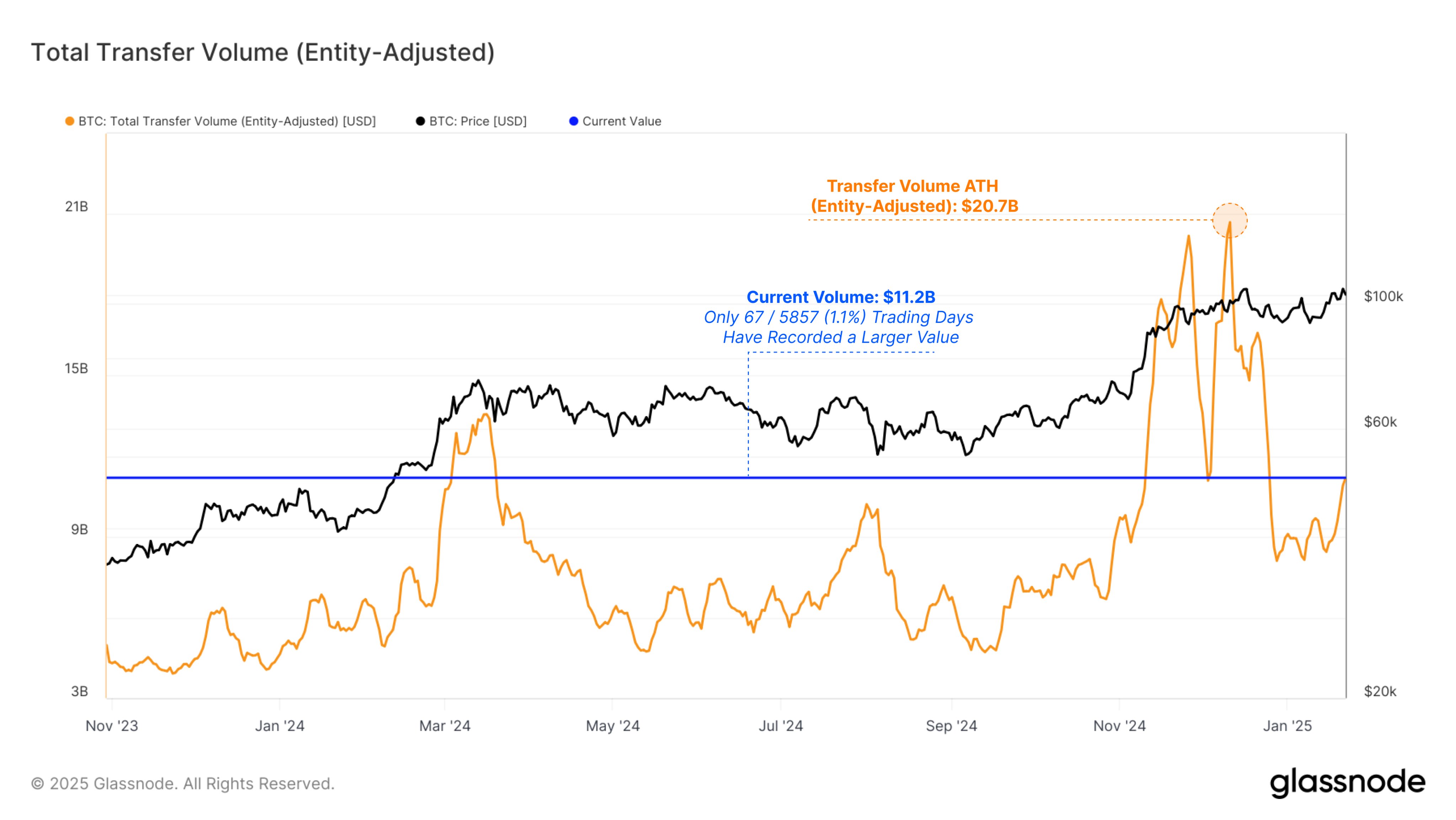

Data from Glassnode, a blockchain analytics firm, shows a significant drop in Bitcoin’s total transfer volume. This “total transfer volume” measures the total amount of Bitcoin (in USD) changing hands on the network daily. High volume generally means investors are actively trading, indicating strong interest. Low volume suggests less activity and potentially waning interest.

Glassnode’s data focuses on “entity-adjusted” volume. This means they’re tracking transfers between different investors, not just individual wallet transactions. Transactions within the same investor’s wallets don’t reflect broader market activity, so this adjustment gives a clearer picture.

The Numbers Tell a Story

The chart shows a massive spike in Bitcoin’s transfer volume late last year, coinciding with Bitcoin hitting record highs above $100,000. This makes sense – big price swings usually attract a lot of attention and trading.

However, since peaking at $20.7 billion in December, volume has plummeted by almost 46%, down to $11.2 billion today. This drop could be a cause for concern, as high transaction volume is often a key ingredient for sustained price rallies.

Historical Context

Despite the recent decline, it’s important to note that the current volume is still historically high. Glassnode points out that only 67 days in Bitcoin’s history have seen higher transaction activity.

Bitcoin’s Current Price

At the time of writing, Bitcoin is trading around $105,300, up slightly over the past week. Whether this price increase is sustainable remains to be seen, given the recent drop in transaction volume.