Bitcoin’s recent price dip has many wondering about its future. One key indicator, open interest (OI), is flashing a warning sign.

What is Open Interest?

Open interest is a measure of how many outstanding Bitcoin futures contracts are currently active. A high OI generally suggests a lot of activity and confidence in the market. Conversely, a falling OI can signal decreasing confidence and potential trouble ahead.

Bitcoin’s Open Interest is Plummeting

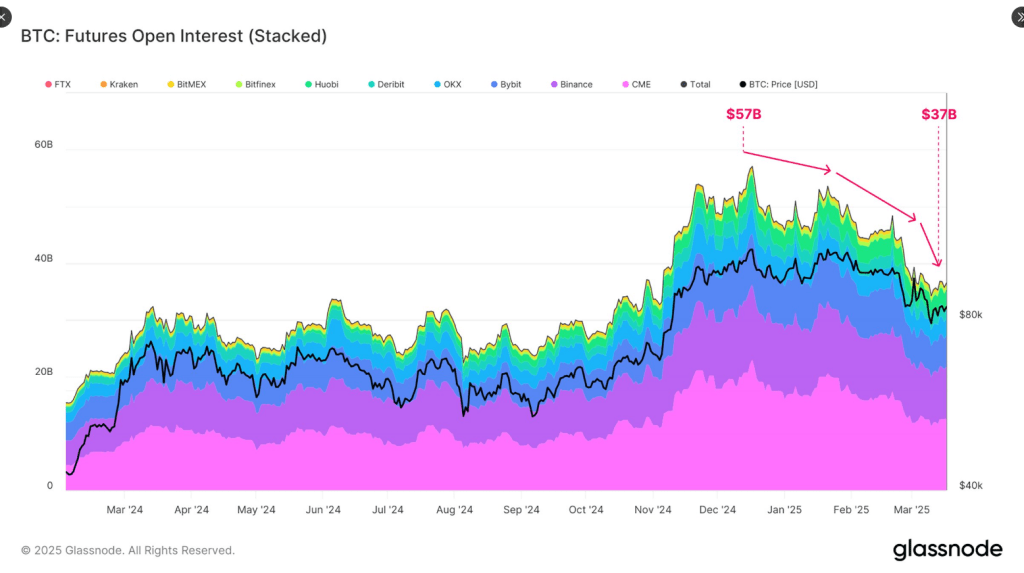

Data from Glassnode shows a significant drop in Bitcoin’s open interest. It’s fallen from $57 billion to $37 billion – a 35% decrease! This decline started after Bitcoin hit its all-time high. This drop mirrors a broader trend of reduced on-chain activity and liquidity.

What Does This Mean for Bitcoin?

This significant drop in open interest suggests investors are becoming less confident in Bitcoin. Many are closing their positions, moving away from leveraged trading, and focusing on short-term gains rather than long-term investments.

Glassnode points to several factors contributing to this shift:

- Cash-and-carry trades are becoming more prevalent:

Investors are holding onto Bitcoin rather than actively trading it.

- CME futures closures and ETF outflows: This indicates a change in investor strategy, adding to the selling pressure.

- Lower liquidity in ETFs: The increased use of ETFs, which generally have less liquidity than futures, might be contributing to short-term price volatility.

Other Concerning Trends

Glassnode also highlighted the “Hot Supply” metric, which tracks Bitcoin held for a week or less. This has plummeted by over 50% in the last three months, indicating less new Bitcoin is being traded. Additionally, daily Bitcoin inflows to exchanges have dropped by 54%, suggesting weaker overall demand.

The Overall Picture

The combination of falling open interest, decreased hot supply, and reduced exchange inflows paints a somewhat gloomy picture for Bitcoin in the short term. While it doesn’t necessarily predict a catastrophic crash, it does suggest a significant shift in market sentiment and reduced activity. Whether this is a temporary dip or a sign of more significant trouble remains to be seen.