What the MVRV Ratio Tells Us

Bitcoin took a tumble last week, dropping below $57,000. While it’s showing signs of recovery, some analysts think this might be the start of a bearish trend.

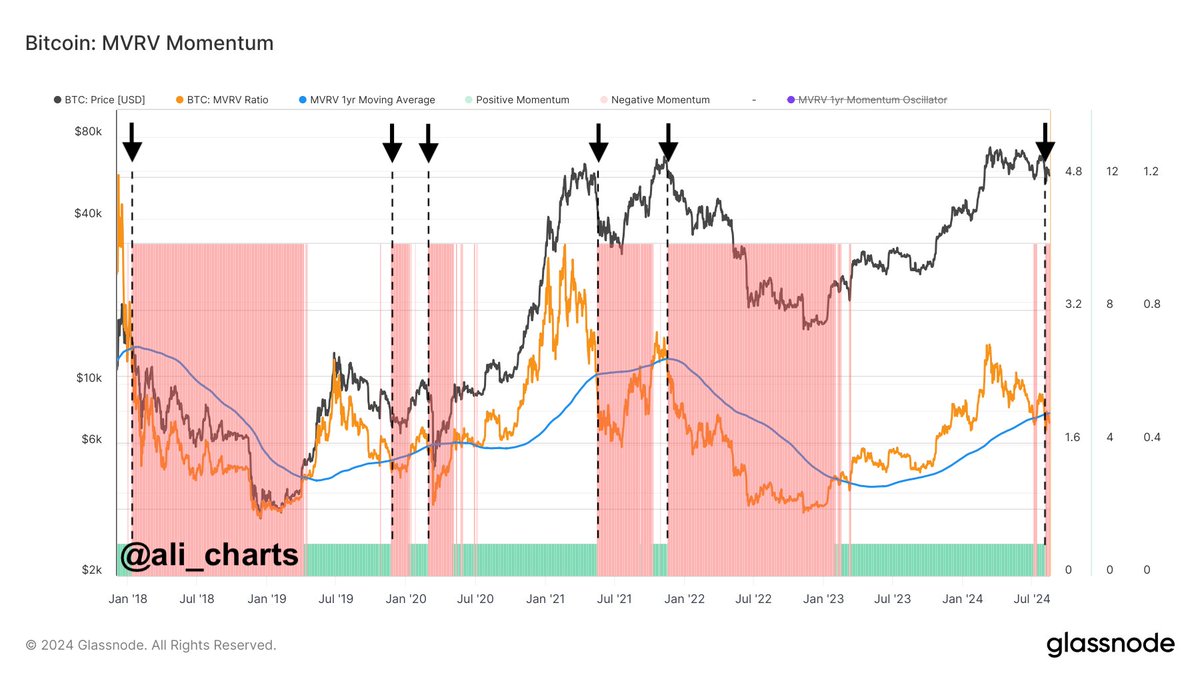

One popular crypto analyst, Ali Martinez, points to the MVRV (Market Value to Realized Value) ratio as a key indicator. This ratio helps us understand the overall market sentiment.

Understanding the MVRV Ratio

The MVRV ratio is calculated by dividing the market value of Bitcoin by its realized value. The realized value is the average price at which Bitcoin was last bought.

The MVRV ratio is often compared to its 1-year simple moving average (SMA). When the MVRV ratio crosses above the SMA, it’s a bullish signal, suggesting that investors are buying Bitcoin at a lower price than the current market value.

On the other hand, when the MVRV ratio dips below the SMA, it’s a bearish signal. This means investors are buying Bitcoin at a higher price than the current market value, which could lead to selling pressure.

A Bearish Signal for Bitcoin?

Martinez says that the recent drop in Bitcoin’s price has pushed the MVRV ratio below its 1-year SMA. This suggests that a lot of Bitcoin was bought at a higher price than the current market value.

This could lead to investors selling their Bitcoin to cut their losses, putting further downward pressure on the price. This could create a vicious cycle where falling prices lead to more selling, further driving down the price.

Bitcoin’s Current Status

Bitcoin is currently trading around $59,000, up slightly in the past 24 hours. However, it’s still down for the week.

While the MVRV ratio suggests a potential bearish trend, it’s important to remember that market sentiment can change quickly. It’s too early to say for sure whether Bitcoin is headed for a major downturn.