Bitcoin has been on a rollercoaster ride lately. After a big jump in price, it couldn’t hold onto its gains and is now trading below $56,000. So, is Bitcoin undervalued?

What’s Causing the Price Dip?

There are a few factors at play:

- Macroeconomic Issues: The overall market is facing some challenges, and Bitcoin is feeling the heat.

- Bitcoin ETFs: The excitement around Bitcoin ETFs has cooled down a bit, leading to less buying pressure.

- Government Sell-Off: The German government sold off a bunch of Bitcoin it seized a few years ago, adding to the downward pressure.

Is Bitcoin Undervalued?

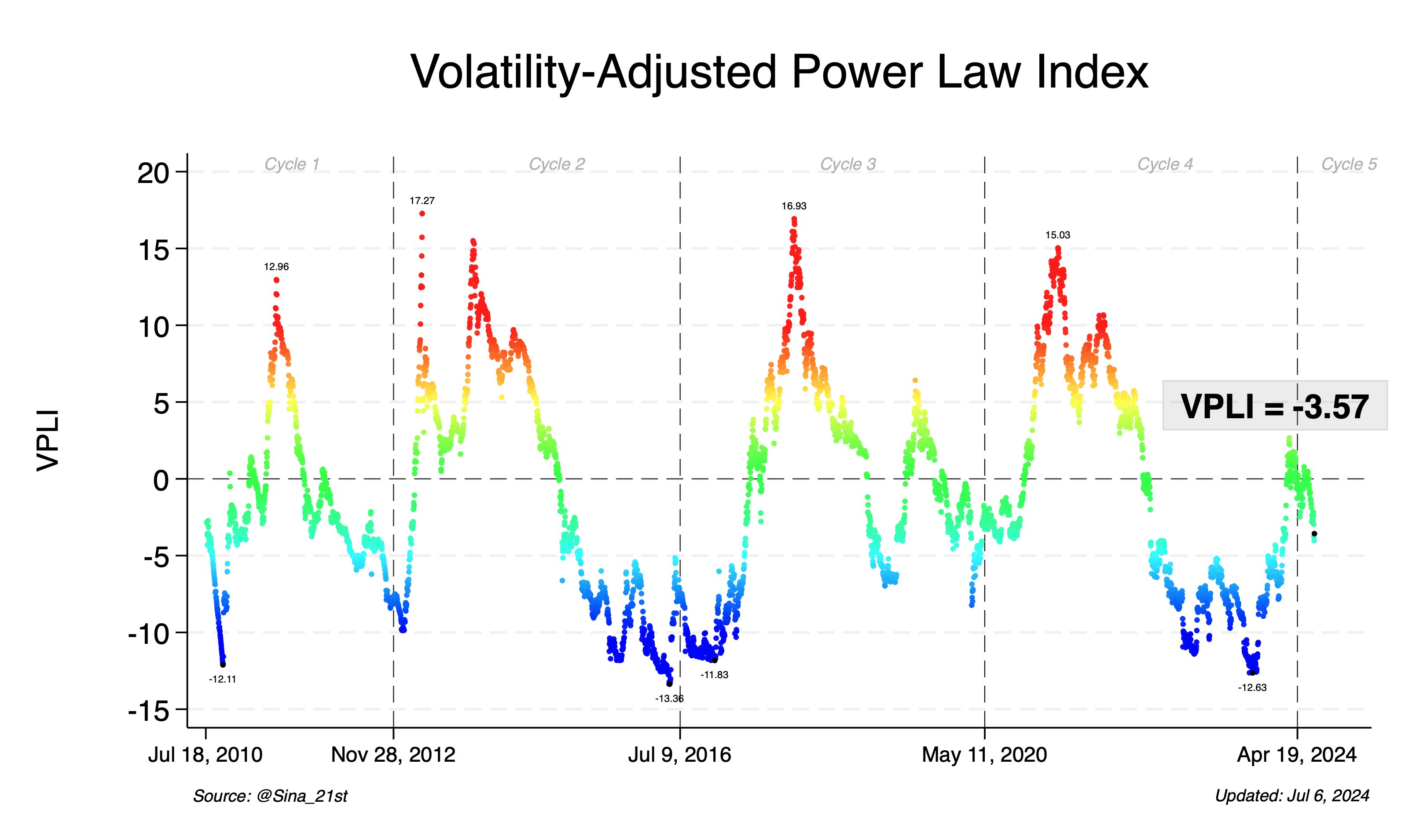

According to Sina G, COO of 21st Capital, Bitcoin might actually be a good deal right now. They use a metric called the Volatility-Adjusted Price Level Index (VPLI) to measure Bitcoin’s fair value.

- The VPLI score is currently -3.57, which suggests Bitcoin is below its fair price.

- Historically, a VPLI score of -10 indicates a bear market bottom.

This means that Bitcoin could be undervalued, offering a good risk-reward balance for investors.

What’s Next for Bitcoin?

Two key factors will influence Bitcoin’s price in the short term:

- German Government Sales: Will the German government continue selling Bitcoin?

- Perpetual Swaps Funding Rate: This rate has been negative recently, suggesting traders are betting on further price drops. However, this could also mean the market is close to hitting bottom.

Overall, Bitcoin is in a tricky spot right now. But, with its potential undervaluation, it could be an interesting investment opportunity for those willing to take a risk.