Hong Kong wants to be a big player in the crypto world, but things aren’t going smoothly. While the city is trying to create a friendly environment for crypto businesses, getting a license from the Securities and Futures Commission (SFC) is proving to be a real challenge.

Strict Scrutiny and Slow Licenses

The SFC is taking a close look at crypto exchanges, and they’re not happy with what they’re seeing. Over a dozen exchanges have failed to meet the SFC’s standards, with issues like poor cybersecurity and a lack of proper management practices. This has led to delays in getting licenses, and some big names like Crypto.com and Bullish are under investigation.

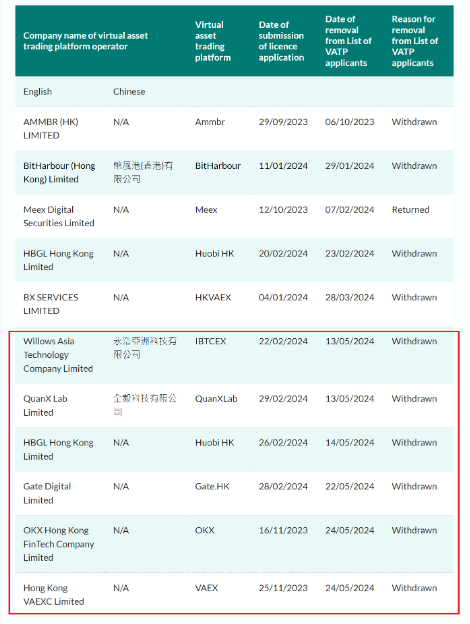

Only two companies, OSL and HashKey, have full licenses in Hong Kong. The SFC hopes to issue more licenses by 2024, but many exchanges are worried about the strict rules and have pulled out of the application process, including Bybit and Huobi HK.

The JPEX Scandal and Increased Regulation

The JPEX scandal, where investors lost over $200 million to an unlicensed platform, has made the SFC even more cautious. They’re focusing on protecting customer assets and making sure exchanges have strong “know your customer” procedures in place.

This crackdown is putting pressure on exchanges that want to tap into the lucrative Hong Kong market. Many of these companies also hoped to serve customers in mainland China, where crypto trading is banned. However, the “One Country, Two Systems” framework means that Hong Kong-based exchanges can’t easily operate in mainland China.

Competition From Singapore

Hong Kong is facing stiff competition from Singapore, which has a more welcoming regulatory environment for crypto businesses. Some people are questioning whether Hong Kong can compete with Singapore and other jurisdictions that are making it easier for crypto companies to operate.

A Future for Crypto in Hong Kong?

Despite the challenges, there’s still hope for Hong Kong’s crypto ambitions. If the city can create a well-regulated environment, it could still become a major crypto hub. But it needs to act quickly and address the concerns of crypto businesses if it wants to stay in the game.