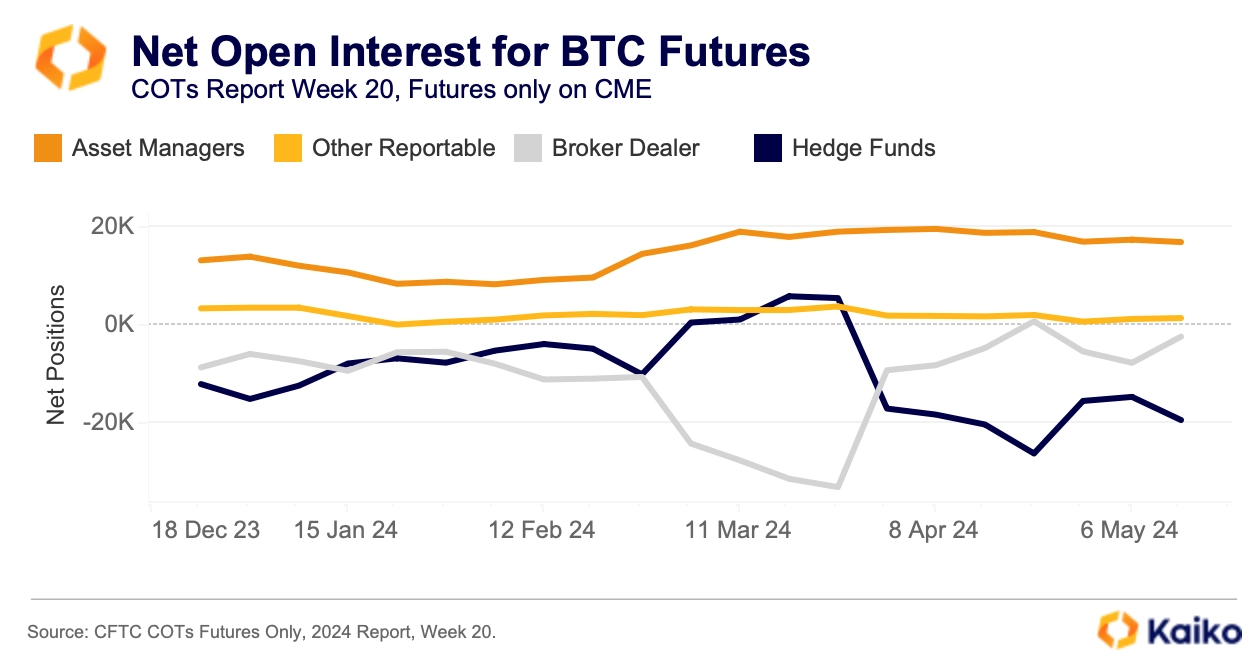

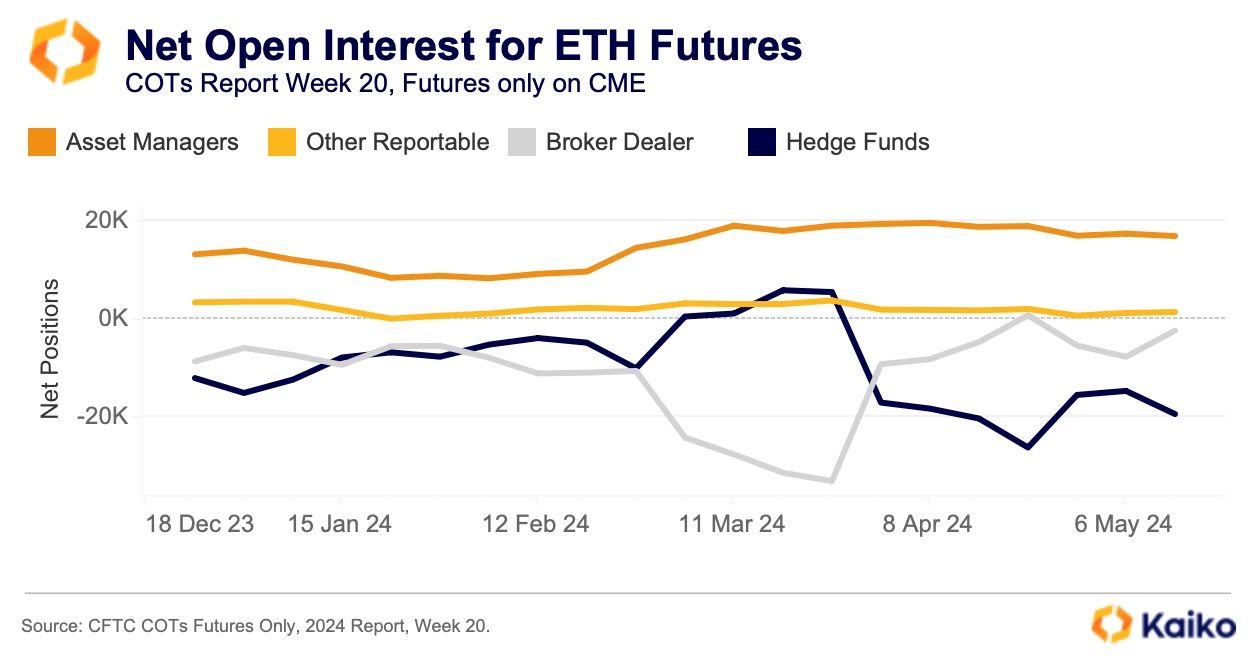

New data reveals that hedge funds are betting against Bitcoin (BTC) and Ethereum (ETH) on the Chicago Mercantile Exchange (CME).

Not Necessarily Bearish

However, this doesn’t mean they’re pessimistic about crypto. Instead, they’re likely engaging in a strategy called “basis trading.”

Basis Trading Explained

Basis trading involves exploiting price differences between two similar assets, in this case, spot and futures prices for BTC or ETH. Hedge funds are currently “long basis,” meaning they’re selling futures while holding spot crypto.

Why Long Basis?

This strategy is profitable when futures prices are higher than spot prices (contango). As expiration approaches, the two prices converge.

Hedge Funds’ Motivation

While it’s not certain, this is the most likely explanation for hedge funds’ short positions. They’re likely hedging against price fluctuations by selling futures while holding spot crypto.

Current Prices

At the time of writing, BTC is trading at $69,251, while ETH is at $3,750.