Ethereum’s price is hovering around $1600, struggling to break free from a downtrend. While there have been brief rallies, the overall picture remains bearish.

Whales Are Selling, and That’s a Problem

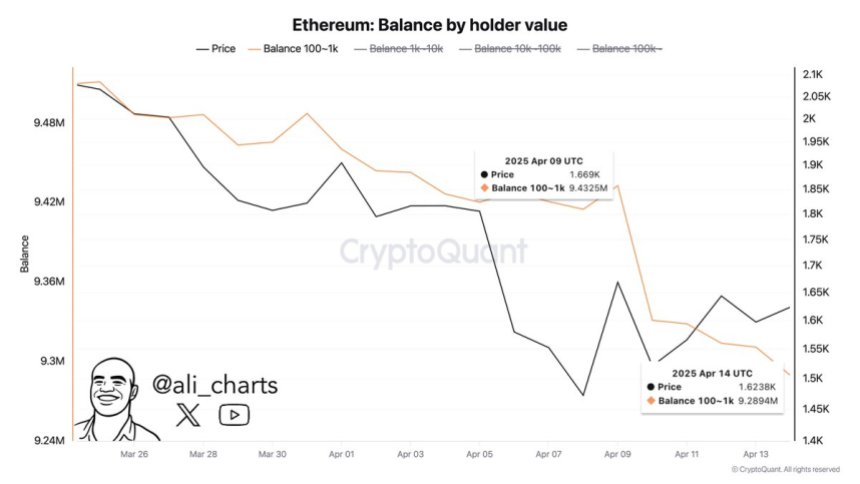

Big Ethereum investors (whales) have sold off a whopping 143,000 ETH in just one week. This massive sell-off is fueling fears of further price drops. It suggests even large holders aren’t confident in Ethereum’s short-term future.

Macroeconomic Woes Weighing Down ETH

The global economy is adding to Ethereum’s woes. Tensions between the US and China, along with a generally uncertain economic outlook, are making investors nervous and less likely to take risks on cryptocurrencies. This uncertainty is creating a bearish environment for Ethereum and other crypto assets.

Ethereum’s Price: A Tightrope Walk

Ethereum’s price is stuck in a volatile range. It keeps bouncing around, but hasn’t managed to establish a solid base. Analysts are watching closely for a breakout.

Key Resistance Levels to Watch

The $1850 level is crucial. If Ethereum can break through and stay above this resistance, along with the 4-hour 200 MA and EMA around $1800, it could signal a turnaround. However, failure to do so suggests further price drops are likely, potentially retesting the $1500 level or even lower.

The Bottom Line: Cautious Outlook

Unless Ethereum can quickly regain and hold key resistance levels, the risk of another significant price drop remains high. The current market conditions are fragile, and the overall outlook is cautious.