Ethereum (ETH) has been on a bit of a rollercoaster lately. While it saw a nice 1.86% jump yesterday, the bigger picture since December 2024 has been pretty gloomy. But don’t count ETH out just yet! There are some interesting signs pointing towards a potential price surge.

Buying Frenzy Despite Falling Prices

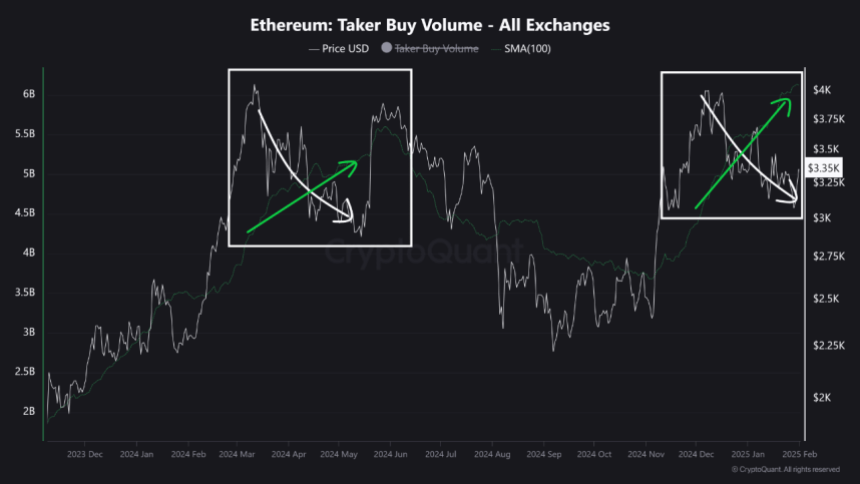

Since hitting $4,000, ETH has been trending downwards, even dipping as low as $3,000. This happened even as Bitcoin was making some serious gains in January. However, a crypto analyst known as Crypto Sunmoon noticed something interesting: buying volume is actually increasing even as the price falls.

This is what’s called a bullish divergence. Basically, it means the price is going down, but buying activity is picking up—a sign that a price reversal might be on the horizon. This suggests strong buyer confidence, with investors expecting demand to outpace supply soon. Based on past performance (like the May 2024 surge, where ETH jumped over 21%), Crypto Sunmoon thinks we could see ETH climb back to $4,000.

Long-Term Holders Show Faith in Ethereum

Adding to the positive vibes, IntoTheBlock reports that long-term ETH holders are holding onto their coins for an average of 2.4 years! That’s a serious vote of confidence in ETH’s long-term potential.

Challenges Remain

However, it’s not all sunshine and rainbows. Ethereum is facing some headwinds:

- Lack of Short-Term Traders: The absence of short-term traders means less speculative trading, which usually fuels quick price increases.

- Competition: The rise of layer-2 solutions (like Optimism) and other layer-1 blockchains (like Solana) is diverting some attention and market share from Ethereum.

Current Market Snapshot

At the time of writing, ETH is trading at $3,306, up 1.86% for the day. Daily trading volume is up a whopping 55.69% at $30.3 billion. While the weekly chart shows a slight increase (0.22%), the monthly chart is still down 2.27%. So, while there’s some positive momentum, it’s still too early to declare a full-blown recovery.