Ethereum has started 2025 with a bang, jumping over 9% in just a few days! This has analysts and investors pretty excited, especially after Ethereum’s relatively sluggish performance compared to Bitcoin in recent months.

A Promising Q1 Trend?

Analyst Daan points out something interesting: Ethereum historically does really well in the first quarter of the year, even when it’s been lagging behind Bitcoin. This suggests a potential rebound is on the cards. The next few weeks will be key to see if this early momentum can be maintained. There’s a lot of hope that 2025 could be a big year for Ethereum, with Q1 setting the stage.

The ETH/BTC Ratio: A Key Indicator

Daan’s analysis of the ETH/BTC ratio highlights the importance of Q1. Historically, big jumps in this ratio during Q1 have often kicked off a period of strong altcoin performance (like in 2020-2021). Breaking above the ~0.04 level in this ratio would be a huge positive for Ethereum. Failure to do so, however, could mean more of the same relative underperformance.

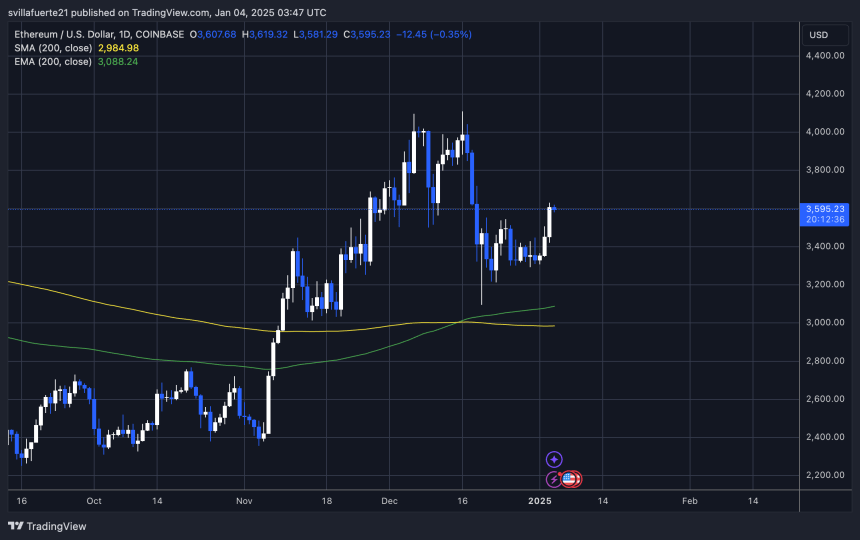

Ethereum’s Price Action: A Critical Level

Ethereum is currently trading around $3,595, having briefly touched $3,629. This is a crucial price point. Breaking above $3,629 convincingly would be a strong bullish signal, potentially leading to further gains. However, the market is still recovering, and some consolidation around the current price is possible. Holding above $3,500 is vital for maintaining the positive momentum. The next few weeks will be crucial in determining Ethereum’s direction.