ETH is currently struggling, but traders are optimistic. While it’s down 9% in the past week, there’s a lot of hope that prices will bounce back.

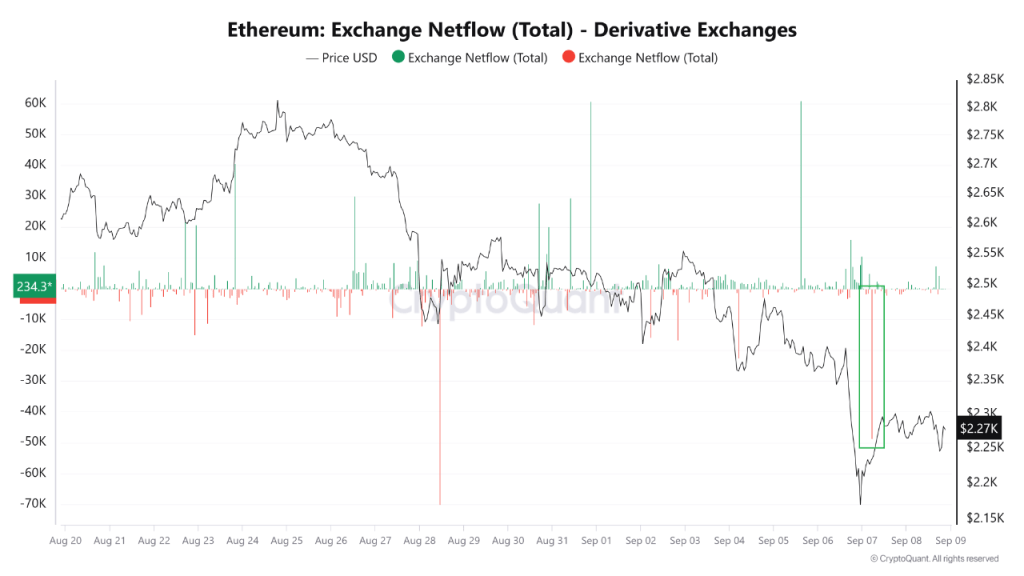

Traders are pulling out of derivatives exchanges. This could be a good sign for ETH. It means that traders are becoming more cautious and less willing to bet on risky positions. They’re moving their ETH to spot exchanges, which could lead to increased buying pressure and higher prices.

However, there are some concerns. Declining gas fees and fading institutional demand are causing some analysts to worry about Ethereum’s long-term sustainability.

Here’s what to watch for:

- If ETH drops below $2,100, it could trigger a sell-off. This would likely cause more traders to move their ETH to spot exchanges or even to stablecoins.

- If ETH breaks above $2,800, it could signal a bullish trend.

This could lead to more traders borrowing ETH to place leveraged positions, pushing prices higher.

The next few trading sessions will be crucial for Ethereum’s future. Keep an eye on these key levels and watch for any signs of a change in sentiment. /p>

Keep an eye on these key levels and watch for any signs of a change in sentiment. /p>