Ethereum (ETH) has seen some price dips recently, dropping over 19.5% before finding support around $3,100. While it’s shown slight recovery since then, a closer look at wallet activity paints a bullish picture for the long term.

A Huge Increase in Long-Term Ethereum Holders

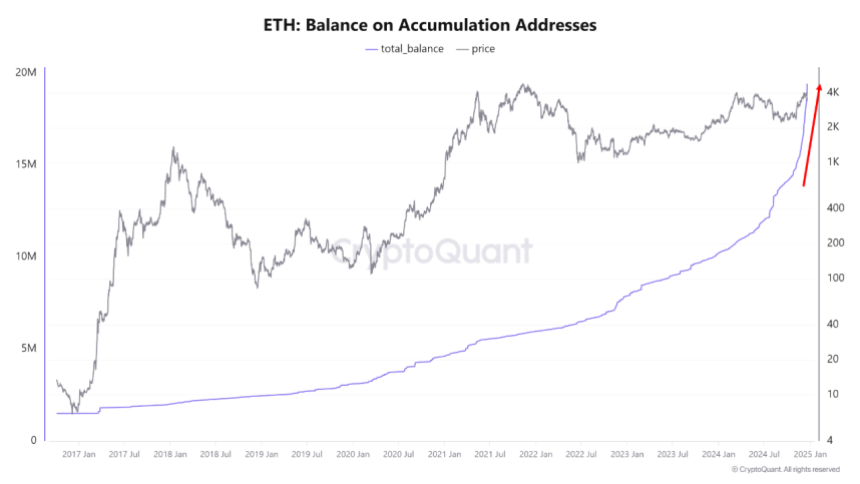

CryptoQuant analyst MAC_D revealed some interesting data: The amount of ETH held by “accumulation addresses” – wallets that rarely trade – has exploded. These addresses increased their holdings by a massive 60% between August and December! That means their share of the total ETH supply jumped from 10% to 16% – a whopping 19.4 million ETH.

This is significant because these addresses represent long-term investors who are confident in Ethereum’s future. MAC_D points out that this level of accumulation is unprecedented in previous bull markets.

Why the Surge? A Hint of Trump?

The analyst suggests that the increased accumulation is linked to positive expectations surrounding a potential Donald Trump administration. The belief is that a Trump presidency might lead to more favorable regulations for the decentralized finance (DeFi) industry, a major part of the Ethereum ecosystem. Regardless of short-term price fluctuations, these long-term holders are betting big on Ethereum’s future growth.

Ethereum’s Price: Short-Term vs. Long-Term

MAC_D cautions that short-term price movements might be heavily influenced by broader economic factors. The recent price drop, for example, could be linked to concerns about future interest rate cuts. Currently, ETH is trading around $3,352, down slightly. Trading volume is also down significantly.

Despite these short-term dips, ETH is still significantly higher than its price before the post-election rally, suggesting strong long-term confidence. It remains the second-largest cryptocurrency by market cap, boasting a massive $401 billion.

The Bottom Line

While short-term price volatility is expected, the substantial increase in ETH held by long-term investors is a very positive sign. This suggests strong underlying confidence in Ethereum’s future, potentially driven by expectations of favorable regulatory changes.