Ethereum (ETH) is making some interesting moves, and analysts are buzzing about what it all means for the price. Recent data shows some strong signs that ETH might be ready to take off.

Big Money is Buying ETH

CryptoQuant, a crypto market data provider, has noticed some key trends:

-

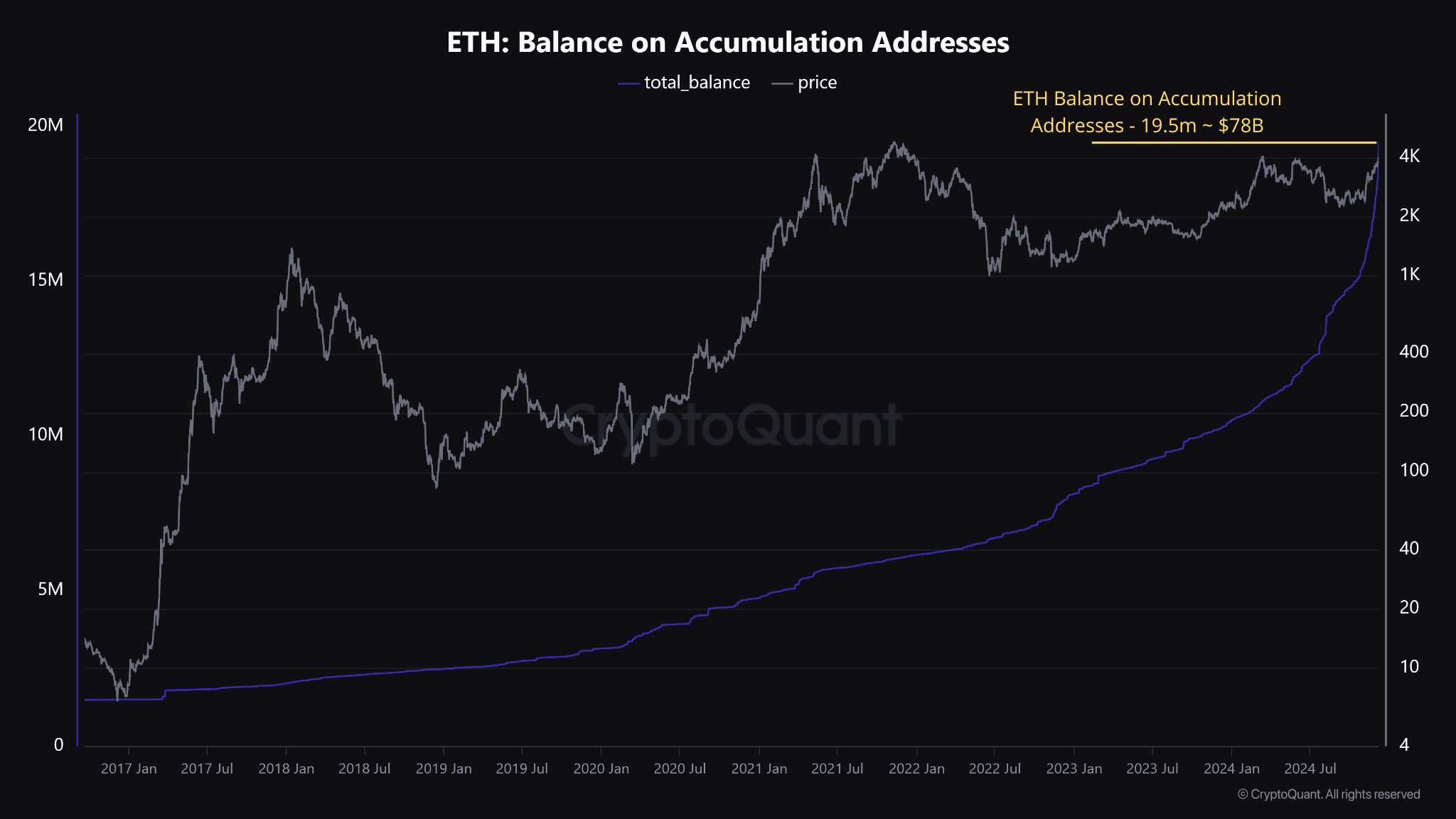

Huge Accumulation: A massive amount of ETH, around $78 billion worth, is sitting in “accumulation addresses.” These are wallets known for holding onto their crypto for the long term. While Bitcoin accumulation is higher in dollar terms, this is expected given Bitcoin’s larger market cap. This shows that big investors are accumulating ETH.

-

ETF Inflows are Strong: Ethereum-focused exchange-traded funds (ETFs) have seen a consistent flow of money in recent months. There were some huge spikes, including over $1 billion on November 11th and nearly $840 million on December 4th, 2024. This is a clear sign that institutional investors are piling into ETH.

Here’s a quick look at those ETF inflow spikes:

- November 11, 2024: $1.1 Billion

- November 21, 2024: $754 Million

- November 25, 2024: $629 Million

- November 27, 2024: $883 Million

- December 4, 2024: $839 Million

ETH vs. Bitcoin: A Different Story This Time?

Interestingly, even with all this positive activity, ETH’s price hasn’t exploded like Bitcoin’s has this cycle. Historically, ETH’s price peaks have lagged behind Bitcoin’s. But this time, it’s underperforming, which could mean a shift in the market.

What About the Selling?

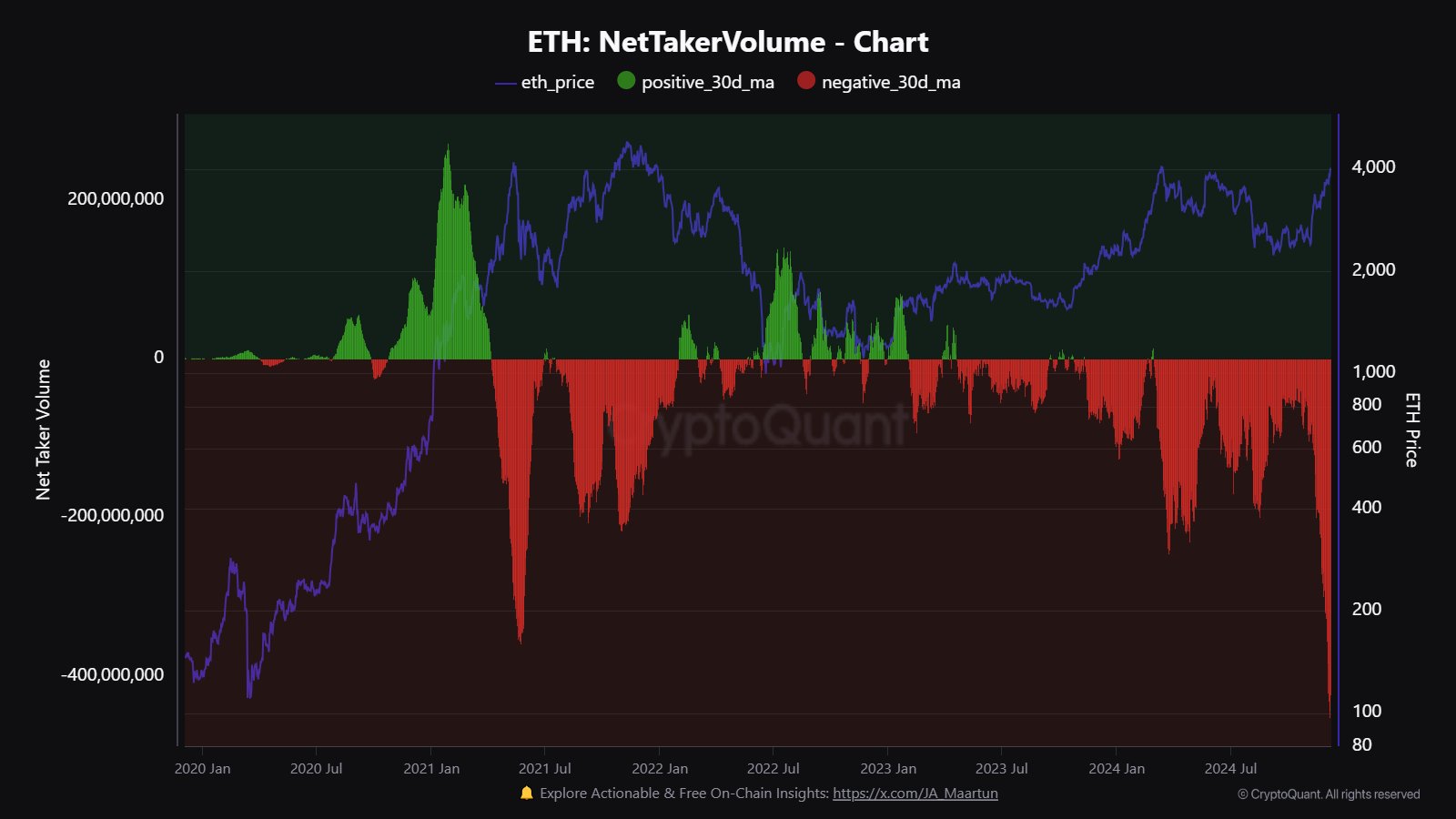

One thing to watch is Ethereum’s “taker volume.” This measures aggressive buying and selling. Right now, it’s at a record low, showing a lot of selling pressure. This is similar to what happened before ETH’s big price jump in 2021. While this looks bearish on the surface, it could also signal a turning point.

The Bottom Line: Potential for Growth

Despite the current selling pressure, the combination of huge accumulation, strong ETF inflows, and the low taker volume suggests that ETH could still have significant upside potential. It’s a complex situation, but the signs are pointing towards a potentially exciting future for Ethereum.