Ethereum (ETH) had a rough start to the year. It’s down a whopping 43% year-to-date, making it one of its worst-performing quarters ever. This is a stark contrast to Bitcoin (BTC) and XRP, which are up significantly.

A Rocky Start

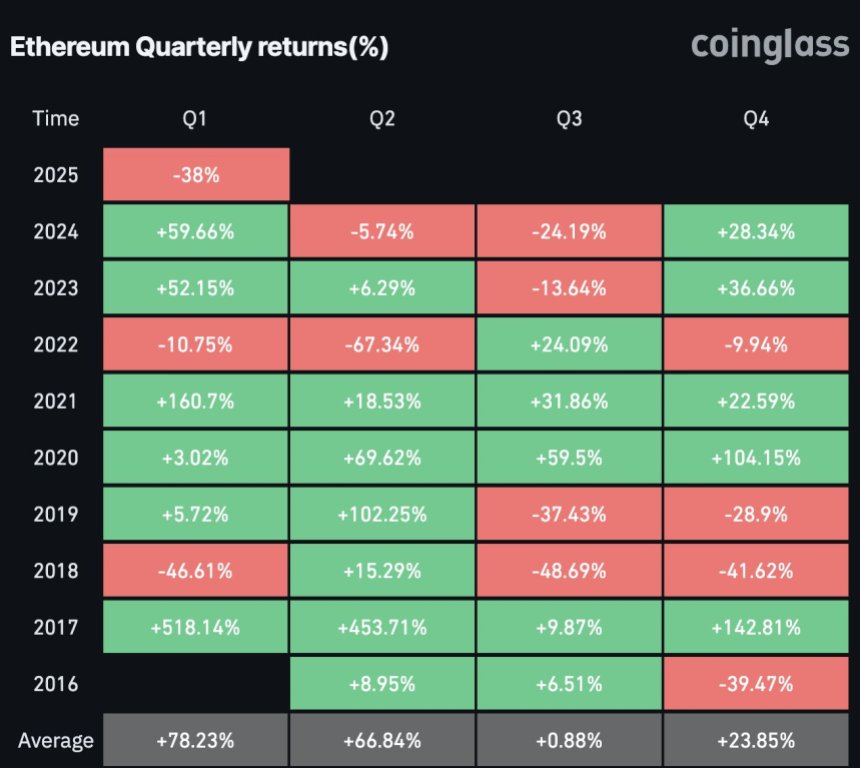

ETH is currently trading just above $2000, a crucial support level. Market expert Lark Davis pointed out that ETH dropped 38% in Q1—almost as bad as its 46% drop in Q1 2018. After that 2018 drop, ETH saw a small recovery followed by further declines, raising concerns about a similar pattern this year.

Potential for a Big Q2?

Despite the gloomy outlook, Davis suggests Q2 could be explosive for ETH. Historically, ETH has seen an average 66% surge in Q2 since 2016. A 60% increase this year could push the price to $3200, levels last seen in early February.

Long-Term Bullish Outlook

Many analysts remain optimistic about ETH in the long run. Analyst Merlijn compares the current situation to Bitcoin’s past performance, predicting a similar recovery for ETH. They even forecast a potential price of $24,000—an 1100% increase!

Roadblocks Ahead

However, the road to recovery isn’t easy. Analyst Ali Martinez highlights key resistance levels ETH needs to break through. While ETH recently reclaimed its realized price of $2040, the next hurdle is $2300. Despite a recent 10% jump, ETH is still down about 25% for the month.