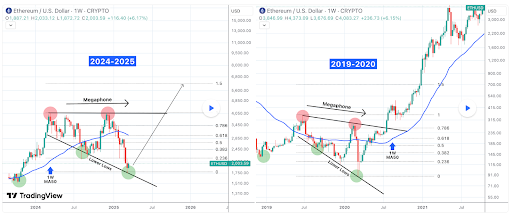

Ethereum’s price is showing a pattern that hasn’t been seen since 2020 – a “megaphone bottom.” This could be a really good sign for the cryptocurrency.

What’s a Megaphone Bottom?

A crypto analyst, TradingShot, noticed that Ethereum’s price chart resembles a megaphone bottom, similar to what happened in March 2020. This pattern shows a period of consolidation where the price fluctuates within increasingly narrowing boundaries, before eventually breaking out.

After three weeks of price drops, Ethereum seems to be starting an upward bounce. The analyst points out that the current price action is tracing a lower lows trendline, forming the bottom of a year-long megaphone shape.

History Repeating Itself?

TradingShot draws parallels between the current situation and the period leading up to the March 2020 bottom. Just like then, we’ve seen a bearish trend since late December. The Fibonacci retracement levels also line up remarkably well, suggesting a potential price increase. He predicts Ethereum could reach at least $6,000 before the year ends. Another analyst, Crypto Patel, is even more bullish, suggesting a possible surge to $8,000. However, there might be some resistance around $4,050.

Strong Fundamentals Fueling the Bullish Outlook

Despite recent price dips, Ethereum’s fundamentals are actually quite positive.

-

Decreasing Exchange Reserves:

Analyst Alternative Bull highlights a significant drop in ETH held on exchanges. This means less readily available ETH, potentially leading to a price surge. He also believes Ethereum is still early in its bull run.

Analyst Alternative Bull highlights a significant drop in ETH held on exchanges. This means less readily available ETH, potentially leading to a price surge. He also believes Ethereum is still early in its bull run. -

Whale Accumulation: Analyst Ali Martinez points out that large investors (“whales”) are actively buying ETH. A recent withdrawal of 360,000 ETH from exchanges in just 48 hours could create a supply shock, pushing the price up.

-

ETH ETFs: The potential approval of Ethereum exchange-traded funds (ETFs) could also tighten supply. If approved, institutional investors might choose to stake their ETH, further reducing the circulating supply.

The Current Situation

At the time of writing, Ethereum is trading around $1,969, slightly down for the day. But the megaphone bottom pattern, combined with positive fundamental indicators, paints a potentially bullish picture for Ethereum’s future.