Ethereum has been on a roll lately, with its price climbing over 8% and breaking the $2,600 mark. But amidst this bullish run, some experts are raising eyebrows about what’s to come.

A Big Deposit: What Does It Mean?

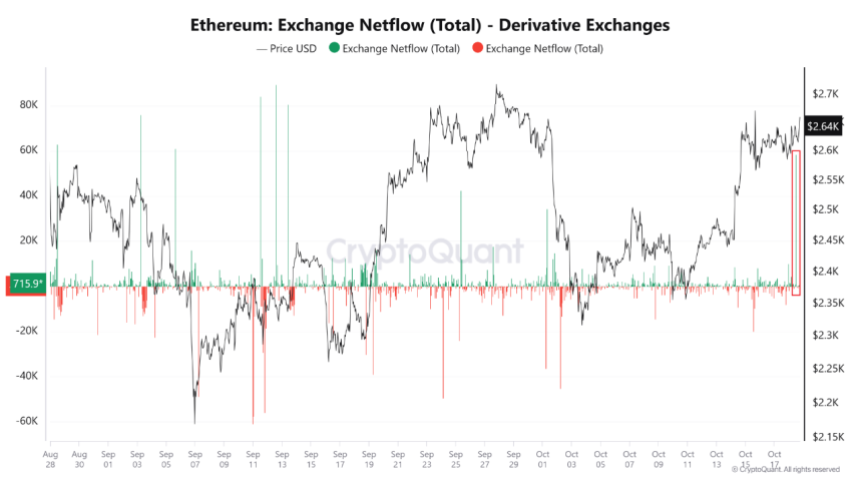

A recent report showed that over 50,000 ETH (worth over $132 million) flowed into derivative exchanges. This means more ETH was deposited than withdrawn.

So, what does this mean for Ethereum’s price? It’s a bit of a mystery. Here’s the breakdown:

- Scenario 1: Sell-Off Ahead? Some analysts believe this influx of ETH could signal a potential sell-off. Traders might be getting ready to dump their ETH by either opening short positions (betting the price will drop) or selling futures contracts.

- Scenario 2: Confidence Boost?

On the other hand, this could mean traders are confident in Ethereum’s future and are depositing ETH as collateral for margin or futures contracts, betting on the price going up.

On the other hand, this could mean traders are confident in Ethereum’s future and are depositing ETH as collateral for margin or futures contracts, betting on the price going up.

Essentially, this big deposit could push Ethereum’s price in either direction, depending on what traders decide to do.

Ethereum’s Next Challenge: The $2,700 Wall

While Ethereum is currently trading at $2,636, it’s approaching a crucial resistance level at $2,700. This level has acted as a ceiling for the past two months, stopping Ethereum from going higher.

However, not all is doom and gloom.

- Positive Indicators: Ethereum’s daily trading volume is up, and the Relative Strength Index (RSI) is still far from the overbought zone, suggesting the rally might not be over yet.

- Bullish Pattern: Some analysts see an ascending triangle pattern on the hourly chart, which points to a potential surge past $2,700 and even reaching $2,870 in the coming days.

So, will Ethereum break through the $2,700 resistance and continue its climb? Or will it succumb to selling pressure and head back down? Only time will tell.