Ethereum (ETH) has seen a recent price jump of over 3%, mirroring a broader crypto market upswing. But a closer look at the data paints a different picture.

Ethereum’s Tight Trading Range

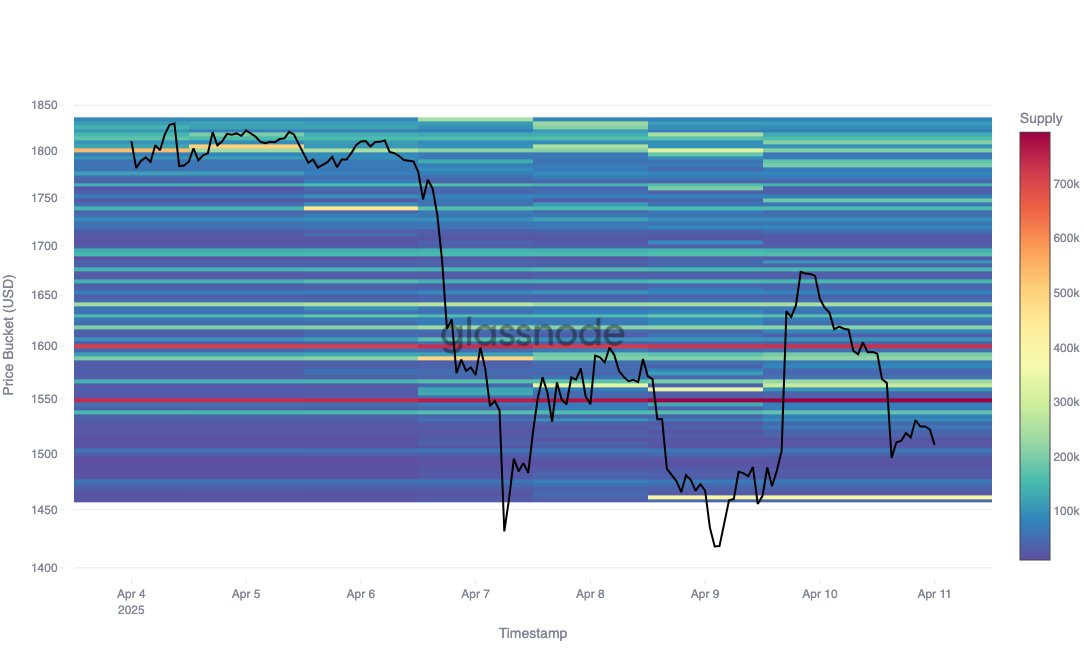

Blockchain analytics firm Glassnode reports that ETH is stuck between $1,548 and $1,599. They’re looking at the cost basis distribution (CBD) – basically, where people bought their ETH. A huge chunk of ETH (1.53 million, worth $2.4 billion!) was bought around these prices. This makes them key support and resistance levels. Specifically, a lot of ETH was bought at $1,548, making it a strong support floor. Conversely, a large amount sits at $1,599, acting as a ceiling.

Interestingly, ETH has tested both these levels recently without breaking through either. This suggests a period of sideways trading could be ahead, unless something big shakes things up in the market. This sideways movement makes sense given the current economic uncertainty and tighter money supply.

Another Important Support Level

Glassnode also points out another significant support level forming at $1,461. Around $595.8 million worth of ETH was bought at this price. If ETH breaks below the $1,548-$1,599 range, this level should provide some support. However, falling below $1,461 could trigger a sharper drop, potentially to $1,400 or even $1,200.

The Current Situation

Right now, ETH is trading around $1,562, up 3.35% in the last 24 hours. But the bigger picture shows a correction, with losses of 14.56% and 18.45% over the past week and month, respectively. Trading volume is also down 34.06%, hinting at less market activity and a possible end to the recent rally. This could further support the idea of a prolonged period of sideways price movement.