Ethereum (ETH) has been on a rollercoaster ride lately. After hitting a high of nearly $5,000 in August, it’s now trading around $4,000. But some analysts are still bullish, predicting a significant price jump.

Will ETH Reach $5,500?

One analyst from CryptoQuant points to a few key factors supporting a potential rise to $5,500:

-

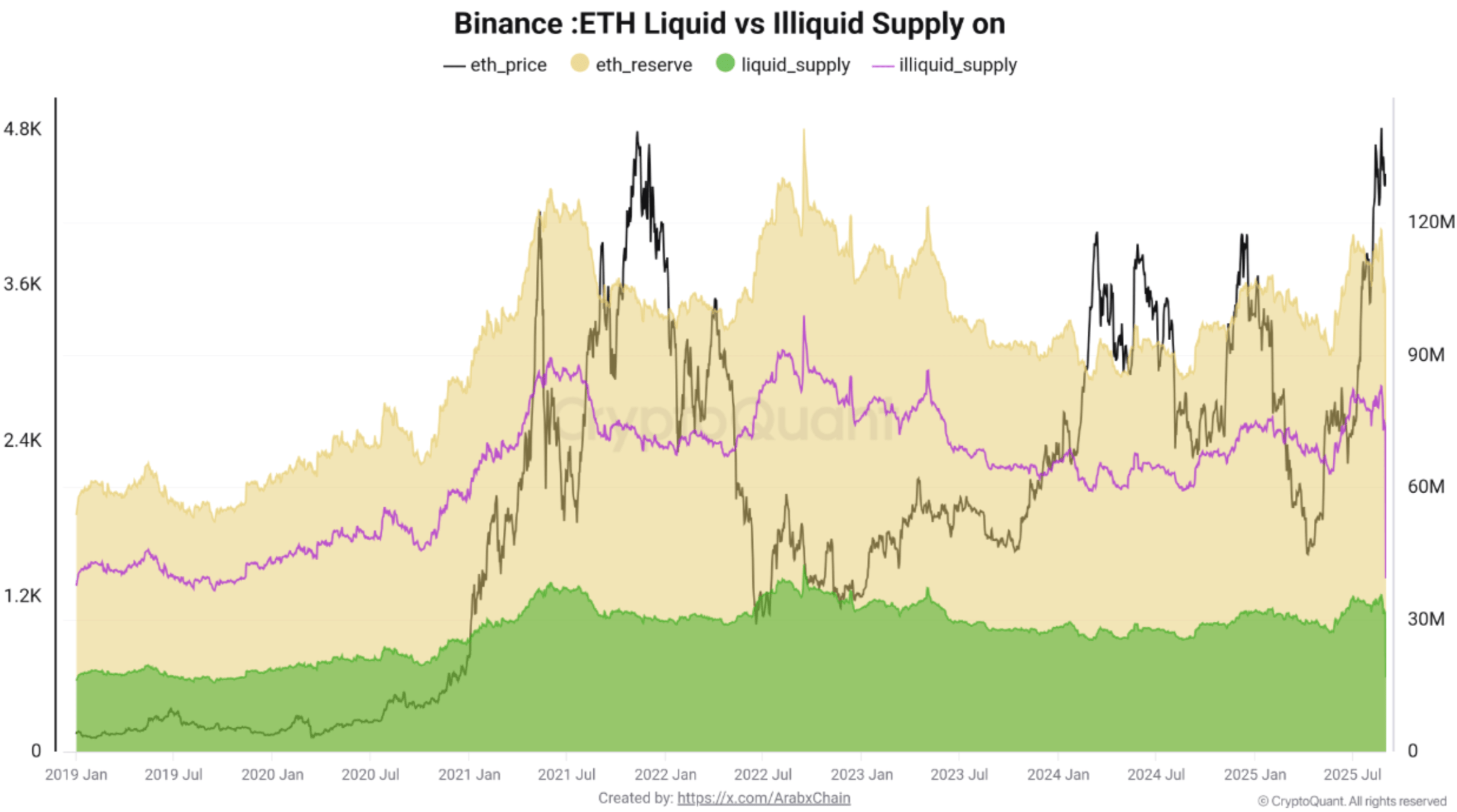

Illiquid Supply: Most of the ETH supply isn’t readily available for trading, creating a shortage. This scarcity can drive up prices. The chart they shared showed a large portion of ETH is illiquid (beige), with only a small increase in liquid (green) supply.

-

ETF Momentum:

Positive developments in the ETF market are also boosting ETH’s prospects.

Positive developments in the ETF market are also boosting ETH’s prospects. -

Binance Reserves: While a recent increase in ETH reserves on Binance (meaning more ETH is being held on the exchange, potentially for selling) is a short-term concern, it’s not necessarily a deal-breaker. If this inflow slows or reverses, the supply shortage will remain strong.

The analyst predicts a sideways or slightly bullish movement in September, with a price range of $4,300 to $5,000. However, if ETH fails to break the $4,800 resistance level and Binance reserves keep rising, a correction down to $4,200 is possible.

Other Perspectives and Predictions

While some analysts are cautious, others are more optimistic. On-chain data shows that large ETH holders (“whales”) are accumulating ETH at a rapid pace. One report even stated that whales added a massive 260,000 ETH to their wallets on a single day!

Joseph Lubin, co-founder of Ethereum, has made a bold prediction, suggesting ETH could increase its value by a factor of 100.

The Current Situation

At the time of writing, ETH is trading at $4,429, a slight increase over the past 24 hours. Whether it will reach $5,500 remains to be seen, but the combination of illiquid supply and positive market sentiment suggests the possibility of further growth.