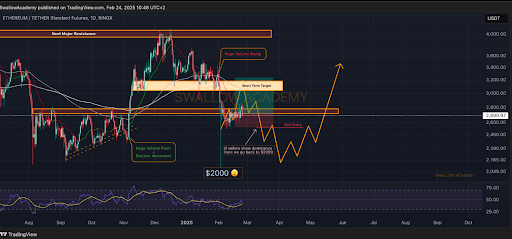

Ethereum’s price has taken a major dive, and some analysts think it could fall all the way to $2,000.

A Rapid Descent

The crypto market took a big hit recently, with Bitcoin dropping below $29,000 and Ethereum falling a whopping 12.6% in just 24 hours. Ethereum broke through several support levels ($2,600, $2,500, and $2,400) in rapid succession. This sharp drop is even more concerning given that buyers had previously held above the $2,700 support level.

What’s Behind the Fall?

While the Bybit hack initially seemed contained, the market’s reacting now, and investors are getting nervous. Money is flowing out of crypto investments, adding to the downward pressure on Ethereum. Currently, sellers are firmly in control, a significant shift from the recent buying sentiment.

The $2,000 Prediction

Analyst SwallowAcademy noted bearish signals on shorter timeframes, reinforcing the possibility of a drop to $2,000. While the weekly chart isn’t definitively bearish yet, the daily chart shows Ethereum trading below key moving averages (EMAs). If the selling continues and breaks below $2,200, $2,000 is the next likely target before any potential rebound.

Is the Bottom In Sight?

Although Ethereum’s price has fallen significantly, indicators like the Relative Strength Index (RSI) haven’t yet hit oversold levels. This suggests sellers might have more room to push prices down before exhaustion sets in. The situation remains volatile, and the next 24 hours will be crucial in determining the next move. Ethereum is currently trading around $2,395.