Even though Ethereum’s price has jumped by 21% in the past week, only two-thirds of its holders are currently making money.

Many Investors Still Holding Losses

The recent price drop in Ethereum really hurt a lot of investors. The price went from a high of $3,400 to a low of $2,100 in just a week. While the price has since rebounded to over $2,700, many investors are still holding losses.

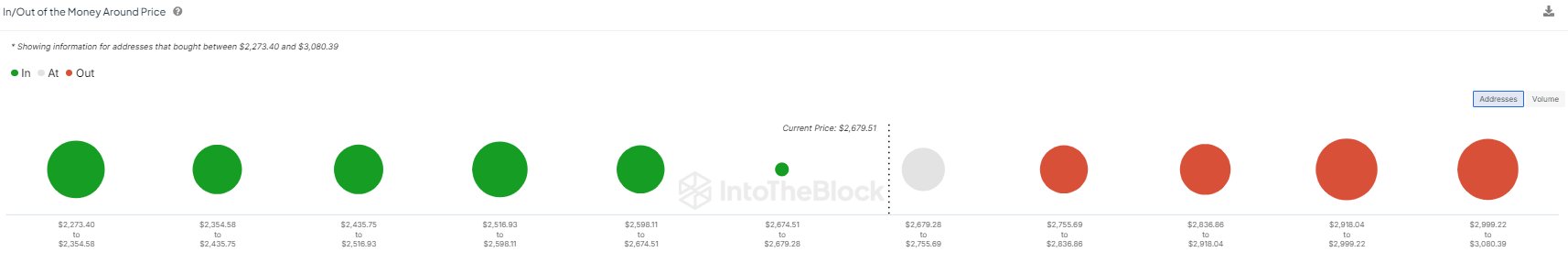

According to data from IntoTheBlock, only 66% of Ethereum holders are currently in profit. This means that a significant number of investors are still waiting for the price to rise back to their purchase price.

Potential for Selling Pressure

A lot of investors bought Ethereum between $2,920 and $3,080. Since the current price is below that range, these investors are losing money. They might sell their Ethereum if the price goes up to their purchase price, which could slow down the price increase.

However, the risk of a major sell-off is probably low right now, since only 66% of investors are in profit. This means that many people are already holding losses and are less likely to sell.

Technical Signals Suggest Potential for Decline

A technical analysis tool called the Tom Demark (TD) Sequential has shown a sell signal on Ethereum’s hourly chart. This could mean that the price could drop, but it’s not likely to be a big drop because the signal is based on a short timeframe.

Current Price and Outlook

As of now, Ethereum is trading at around $2,700, up more than 2% in the last 24 hours. While the price has been recovering, the fact that many holders are still in the red could create some challenges for further price increases.