Ethereum (ETH) has been taking a bit of a beating lately, dropping 17% last week and hitting a low of $2,104. While it’s seen a slight rebound recently, the overall mood is still pretty bearish.

Where Could ETH Go Next?

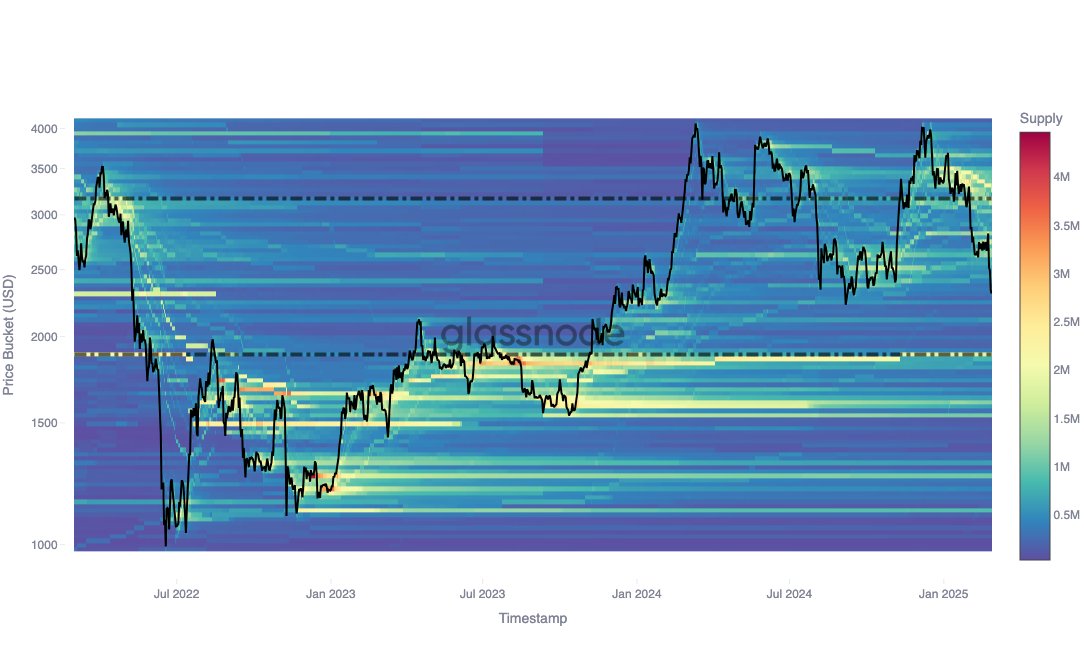

Analysts are looking at key support levels for ETH, and one number keeps popping up: $1,890. Data from Glassnode, a well-known crypto analytics firm, suggests this is the next major accumulation zone. What does that mean? It’s a price level where a lot of investors bought ETH in the past, and this could act as a floor, preventing further price drops. Specifically, around 1.82 million ETH were bought at this price point in August 2023.

Interestingly, many of these investors haven’t sold, even increasing their holdings in November 2024. This shows strong long-term belief in ETH.

But $1,890 isn’t the immediate

Are Investors Buying the Dip?

Looking at the bigger picture (six months), Glassnode sees strong investor activity with a high cost basis (the price they originally paid) – particularly around $3,500. This high cost basis is slowly decreasing, but it’s concentrated, suggesting investors are buying more ETH as the price falls, betting on future gains.

The Current Situation

At the moment, ETH is trading around $2,250, up slightly from its recent lows. While it’s down about 30% this month, its market activity is actually up, now valued at $29.91 billion.