Ethereum (ETH) has been on a downward trend lately. It’s down 17% in the last month and has been struggling to stay above $1,850. Experts are warning that things could get worse.

Ethereum Could Plunge to $1,550

For the past couple of days, ETH has been stuck between $1,750 and $1,840. It failed to break above $1,900 earlier this week. This poor performance follows a significant drop below $2,100 in early March – its lowest point since December 2023. This is ETH’s worst performance in seven years, marking four consecutive months of losses.

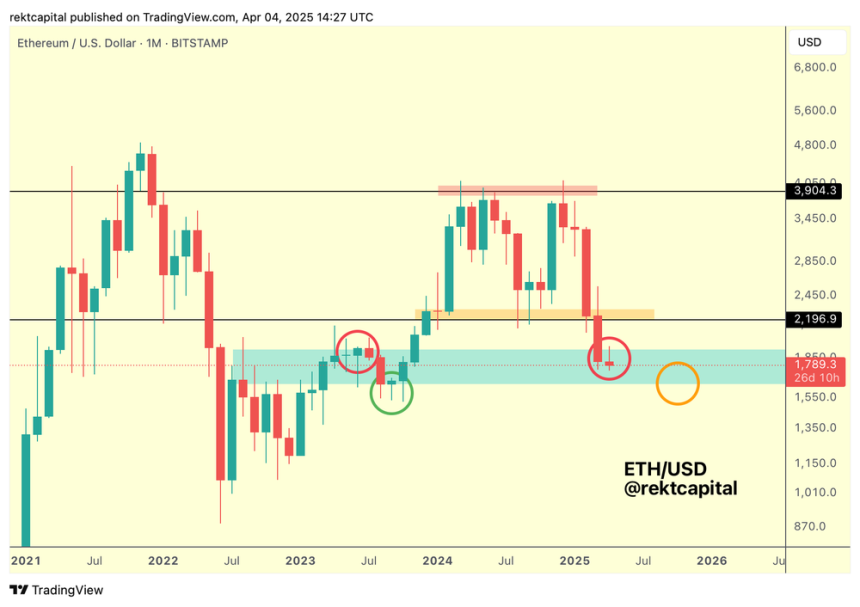

One analyst, Rekt Capital, points to a “double top” formation on the price chart as a reason for the drop. Breaking below a key support level has historically led to further price drops, potentially all the way down to around $1,550 – a significant 15% fall from current levels. To avoid this, ETH needs to reclaim a key resistance level around $1,930.

A Potential Rally?

However, there’s a glimmer of hope. Another analyst, Sjuul from AltCryptoGems, suggests a potential 20% rally based on a technical analysis pattern. They highlight a period of accumulation followed by manipulation, suggesting a breakout could be imminent.

Key Levels to Watch

Analysts agree that $1,750 (support) and $2,100 (resistance) are crucial levels to watch. Breaking above $2,100 would be bullish, while falling below $1,750 would likely lead to further losses. In short, the next few days will be critical for determining Ethereum’s future price movement. As of now, ETH is trading around $1,808.