Ethereum (ETH) might be on the verge of a price surge, according to Ki Young Ju, CEO of CryptoQuant. He recently highlighted several positive factors pointing towards a bullish outlook for the cryptocurrency.

No Major Sell-Off After Recent Hack

Despite the recent record-breaking Bybit hack, the market hasn’t seen significant selling pressure. Young Ju notes that on-chain data and overall market trends remain neutral, suggesting that the hack’s impact might be less severe than initially feared.

Ethereum’s Dominance in Stablecoins

Ethereum currently controls a whopping 56% of the stablecoin market cap. With potential easing of crypto regulations, more companies might adopt ETH-based stablecoins and smart contracts, further boosting Ethereum’s value.

Approved ETFs and Regulatory Tailwinds

The US already has approved and active spot ETH ETFs. This, coupled with potential positive regulatory changes, could trigger a surge in altcoin prices, benefiting Ethereum significantly.

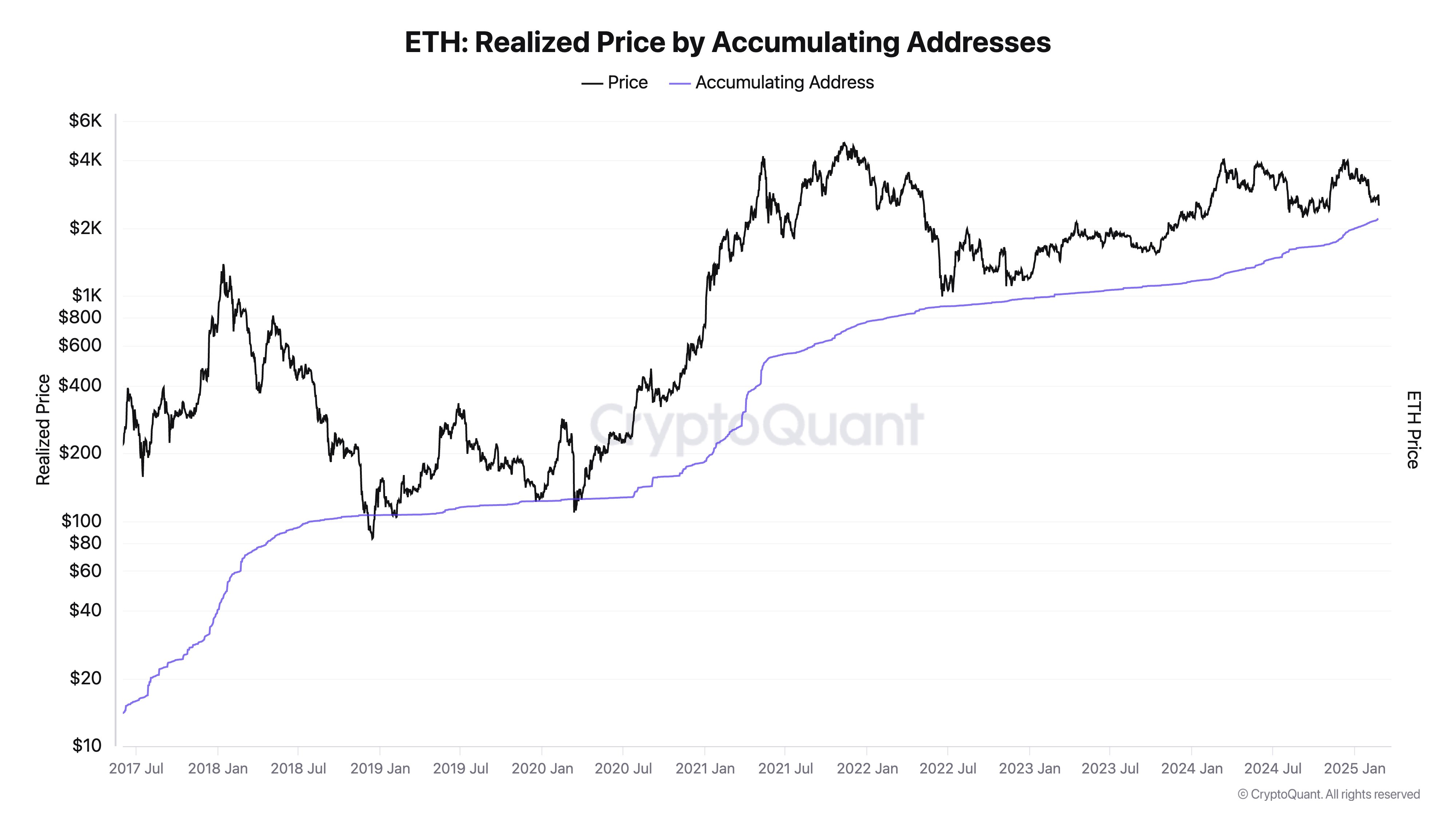

Whale Accumulation

Large Ethereum holders (whales) have been accumulating ETH, another strong bullish signal. The number of wallets holding between 10,000 and 100,000 ETH has increased by 24% over the past year, mostly driven by smaller wallets accumulating more ETH. The current price is approaching the average cost these wallets paid for their ETH.

Current Market Conditions

At the time of writing, Ethereum is trading at $2,424. While it’s down slightly in the last 24 hours and the past week, the potential bullish catalysts mentioned above suggest a possible turnaround.

Disclaimer:

This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies./p>