Ethereum (ETH) is currently hovering around $2,400, a bit below its recent high of $2,700. While the broader crypto market is hopeful for a big rally after the Federal Reserve’s interest rate cut, ETH has struggled to climb higher.

But there’s some good news: On-chain data suggests that selling pressure is decreasing, which could be a sign of a potential rebound for ETH.

Reduced Selling Pressure: A Sign of Hope?

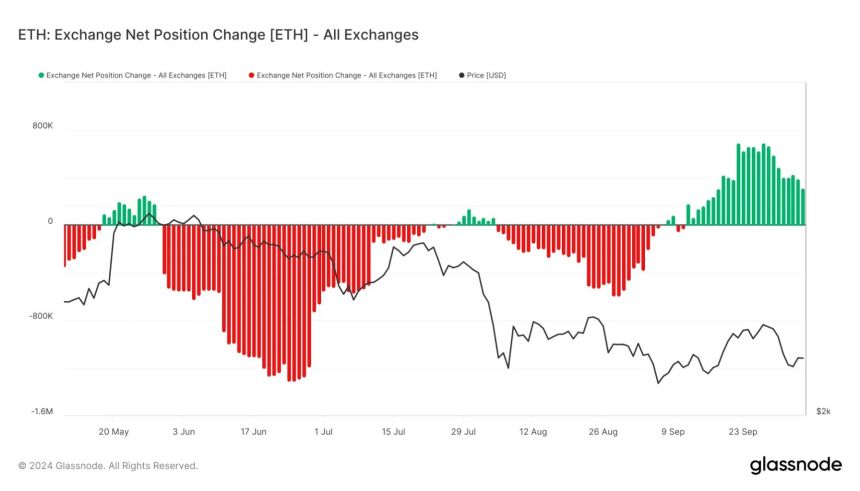

One key indicator is the Ethereum Exchanges’ Net Position Change. This tracks the flow of ETH into and out of exchanges. Recently, this indicator has been trending downwards, meaning fewer investors are moving their ETH to exchanges to sell. This could mean that investors are holding onto their ETH, potentially anticipating a price increase.

Crucial Levels to Watch

ETH is currently testing some important price levels. If it can break above the 4-hour 200 EMA and MA, it could signal a bullish trend reversal and push towards $2,700.

However, if it fails to reclaim these levels, it could drop towards $2,200, potentially triggering a deeper correction.

The next few days will be crucial for ETH. Traders and investors will be closely watching to see if it can reclaim these key levels and regain its upward momentum.

If ETH can successfully break through these resistance levels, it could attract more investment and propel the price higher. This would be a positive sign for the overall crypto market. /p>