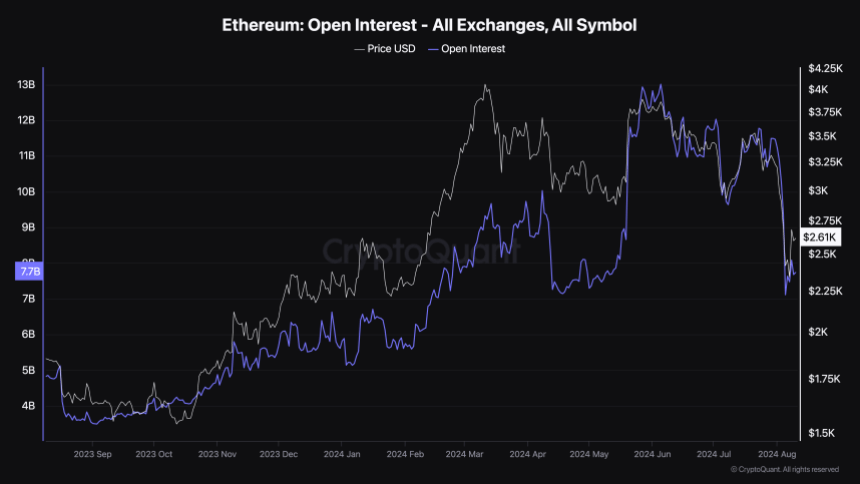

The crypto market has been on a rollercoaster ride lately, with Bitcoin and Ethereum taking a hit. The recent market slump has left investors feeling cautious, and this is reflected in the decline of Ethereum’s open interest.

Open Interest: A Key Indicator

Open interest is a measure of how many derivatives contracts are open on exchanges for a particular cryptocurrency. A high open interest indicates that investors are actively trading futures and options, while a low open interest suggests they are closing their positions or getting liquidated.

Ethereum Open Interest Drops Significantly

In August, Ethereum’s open interest fell by a whopping 40%, or around $6 billion. This downward trend started at the beginning of the month and hit a low point on Monday following the broader market downturn.

What Does This Mean for Ethereum’s Price?

A low open interest can have both positive and negative implications for the price of Ethereum:

Negative:

- Reduced Liquidity:

Fewer open positions mean less liquidity in the market, making it more susceptible to price swings.

Fewer open positions mean less liquidity in the market, making it more susceptible to price swings. - Increased Volatility (Long Term): With fewer investors actively trading, the market could become more volatile in the long run.

Positive:

- Reduced Volatility (Short Term): A low open interest can also mean less short-term volatility as fewer investors are betting on price movements.

Ethereum’s Price Remains Under Pressure

Despite a slight recovery in the past day, Ethereum’s price is still hovering around $2,600, down almost 4% in the last 24 hours. The altcoin has lost more than 13% of its value in the past week.

Overall, the drop in Ethereum’s open interest is a significant development that could have both positive and negative consequences for the price of ETH. It remains to be seen how the market will react in the coming weeks and months.