Open Interest: A Sideways Trend

Ethereum’s Open Interest, the total number of derivative contracts open, has been hovering at low levels after a sharp drop during the recent price decline. This suggests a cooling down in the futures market.

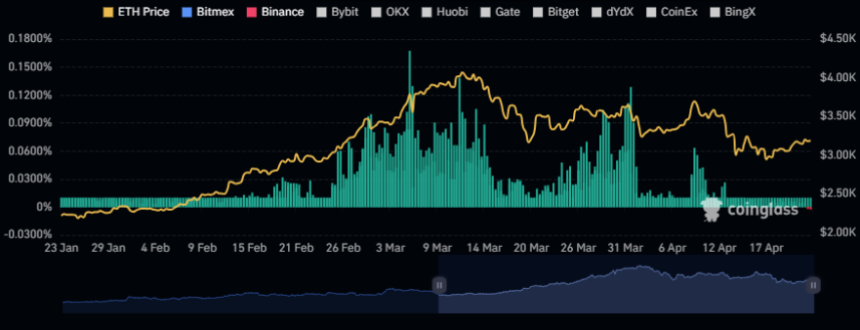

Funding Rate: A Shift to Negative

The Ethereum funding rate, which tracks fees paid between derivative contract holders, has recently turned negative. Historically, this has often signaled a potential reversal against the majority opinion.

Price Action: Gradual Increase

Ethereum’s price has been gradually increasing in recent days, reaching $3,200.

Implications

The low Open Interest and negative funding rate suggest that the market is poised for a fresh move, either up or down. The recent price increase may indicate a shift towards bullish sentiment.