Ethereum, the second-largest cryptocurrency, has been on a rollercoaster ride lately. After a big drop in early August, it managed to climb back up a bit. But experts are worried that this climb might not last.

The Taker Buy/Sell Ratio: A Signal of Trouble?

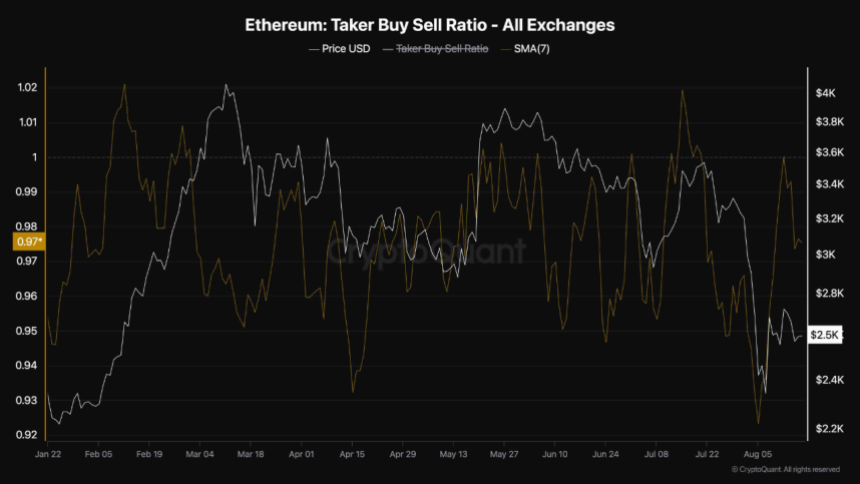

One analyst, ShayanBTC, is keeping a close eye on a metric called the Taker Buy/Sell Ratio. This ratio basically tells us if there are more people buying or selling Ethereum aggressively.

When the ratio is above 1, it means buyers are in control, and the price is likely to go up. But when it’s below 1, sellers are dominating, and the price might fall.

According to ShayanBTC, Ethereum’s Taker Buy/Sell Ratio has been struggling to stay above 1, suggesting that sellers are still in charge. He believes that if the ratio continues to drop, it could lead to another price drop for Ethereum.

What’s Next for Ethereum?

Right now, Ethereum is trading around $2,600. It’s up slightly from yesterday, but it’s still down a lot over the past month.

If buyers can keep pushing the price higher, Ethereum could reach $3,000. But if sellers gain the upper hand, it could fall as low as $2,300.

Overall, the future of Ethereum is uncertain. The Taker Buy/Sell Ratio is a warning sign, but it’s not the only factor to consider. Only time will tell if Ethereum can hold onto its recent gains or if it’s headed for another dip.