Ethereum is a major cryptocurrency, known for its decentralized finance (DeFi) applications, especially smart contracts. These automated contracts eliminate the need for central authorities, potentially sidelining banks.

A Recent Dip and Investor Concerns

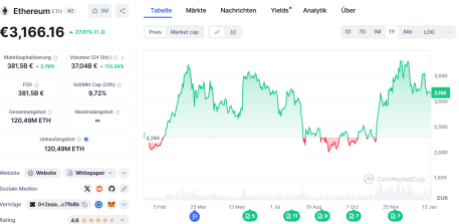

Despite its promising future, Ether (ETH) recently experienced a 10% drop, sparking fears of further declines. While many investors anticipated a surge following Donald Trump’s return to office, a market correction occurred—a common occurrence in the volatile crypto market. Adding to the uncertainty, a large Ethereum holder (“whale”) sold off a portion of their holdings, even at a loss. This is surprising given Ethereum’s seemingly bright future.

Were Gains Premature?

Like Bitcoin, Ethereum benefited from the approval of spot ETFs, which should increase market penetration. The departure of Gary Gensler from the SEC and Trump’s pro-crypto stance are also positive signs. However, Ethereum remains below its all-time high. While the first ETH spot ETF briefly pushed the price above $4,000, it soon fell. This mirrors the Bitcoin spot ETF launch, where market gains were largely pre-empted, requiring time for analysis and reaction.

Trump’s Impact and Future Predictions

Historically, Ethereum has performed well in January. Analysts are optimistic that deregulation under the new US administration will boost the crypto market, including Ethereum.

An Alternative: Solaxy

For investors seeking alternatives, Solaxy ($SOLX), a new meme coin, is worth considering. Currently in its presale on Ethereum, it bridges to the Solana blockchain, leveraging both networks’ strengths. It has already raised €10 million, indicating strong investor interest. Priced at just $0.0016 per token, it could see significant price increases once listed on exchanges. More information is available on X and Telegram.