Ethereum’s price is currently hovering around $2,500, but the bulls are struggling. Even though the price is above $2,500, it’s still stuck within a bearish pattern. To turn things around, we need to see a strong push above $3,500 with high trading volume.

A Bearish Sentiment

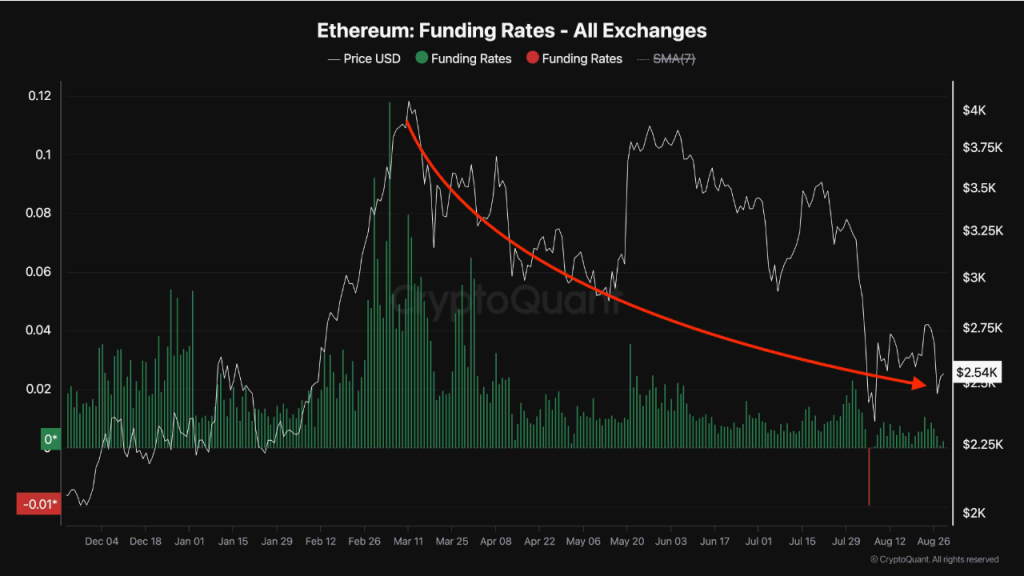

One analyst believes that Ethereum is likely to stay bearish in the short to medium term. They point to the funding rate for Ethereum perpetual contracts, which has been steadily declining despite remaining positive. This suggests that even though Ethereum has seen some price fluctuations, the overall sentiment among traders is bearish.

What is a Funding Rate?

The funding rate is a key indicator of market sentiment in perpetual contracts. It reflects the difference between the price of a perpetual contract and the spot price of the underlying asset. When the funding rate is positive, it means that traders are bullish and expect prices to rise. Conversely, a negative funding rate indicates a bearish sentiment and a potential price drop.

What’s Needed for a Bullish Turnaround?

For Ethereum to break out of this bearish trend, we need to see a surge in buying interest. This would drive up prices and push the funding rate higher, signaling a shift in sentiment.

Spot ETFs: A Potential Catalyst

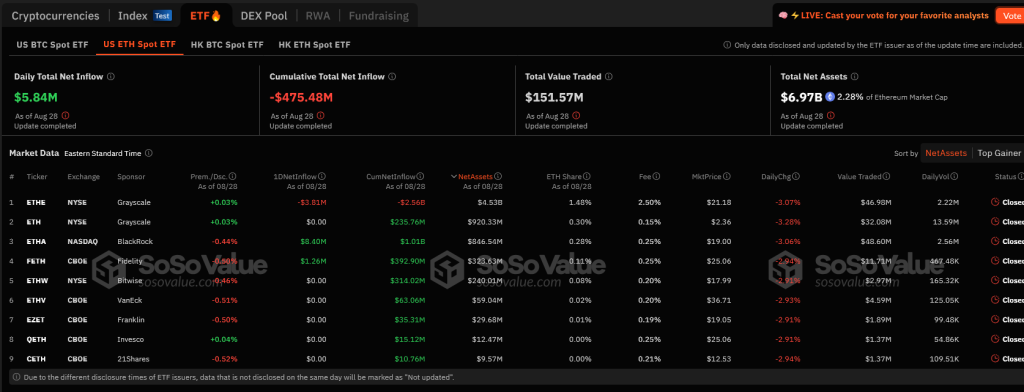

One factor that could potentially boost Ethereum prices is the inflow of funds into spot Ethereum ETFs in the United States. However, while there have been some inflows, they are significantly lower than what was seen in late July.

The Bottom Line

Ethereum’s future remains uncertain. While there is potential for a bullish turnaround, the current market sentiment is bearish. We need to see a significant increase in buying interest and a positive shift in the funding rate before we can expect a sustained price rally.