Ethereum (ETH), the crypto giant, is experiencing a mix of good and bad news.

USDT Inflow: A Sign of Hope?

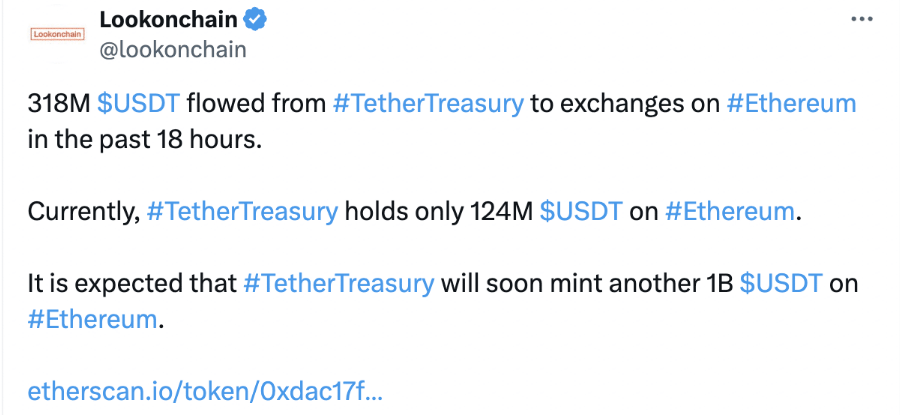

Tether, the issuer of the popular stablecoin USDT, recently transferred a massive $318 million worth of USDT to Ethereum exchanges. This suggests that investors may be anticipating increased demand for USDT, which could lead to a surge in ETH prices.

Price Woes: ETH Struggles

Despite the USDT inflow, ETH’s price has been struggling. It’s currently below $3,000, down 3% in the past 24 hours. A further drop could trigger panic selling.

Network Activity: A Bright Spot

While ETH’s price may be down, the Ethereum network is bustling with activity. DeFi transactions, stablecoin swaps, and token activity are all on the rise. This suggests that other sectors within Ethereum are thriving, even as the NFT market cools down.

Analyst Caution: Not a Guaranteed Success

Analysts warn that the USDT inflow is not a guarantee of prosperity. Other blockchains, such as Tron, can also handle USDT transactions.

Conclusion

Ethereum’s current situation is a complex one. The USDT inflow and network activity offer hope, but the declining price paints a different picture. Investors should approach with caution and monitor the situation closely.