Ethereum recently dipped below $2,000 again, after a brief recovery. While short-term sentiment is cautious, a crypto analyst’s observation offers a potentially bullish outlook.

The 300-Week Moving Average: A Key Level

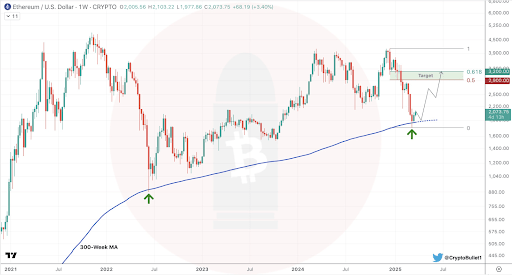

A well-known crypto analyst, CryptoBullet, highlighted that Ethereum has touched its 300-week moving average for only the second time ever. The first time was in June 2022, during a major market crash that saw Ethereum plummet to $880. That dip, however, marked the start of a significant recovery.

Looking Back to Look Ahead

Following the June 2022 touch of the 300-week MA, Ethereum rallied over 140% in eight weeks, exceeding $2,100 before another correction. This historical precedent suggests that the current touch of the 300-week MA could similarly signal a substantial rebound.

Potential for a Bounce, But Challenges Remain

CryptoBullet considers the 300-week MA a crucial support level, predicting a price bounce to between $2,900 and $3,200. However, this depends on Ethereum reclaiming the $2,000 level. Failure to do so could negate any bullish momentum.

The recent price drop also increases the risk of Ethereum closing March below its 3-month Bollinger Bands (around $2,000), which would be a negative sign.

The Bottom Line

While short-term uncertainty remains, the historical significance of Ethereum hitting the 300-week moving average, coupled with the analyst’s prediction, hints at a potential mid-term price increase. Only time will tell if this prediction holds true. At the time of writing, Ethereum is trading at $1,907, down 5.82% in the last 24 hours.