Ethereum has been on a roll lately, but it took a sudden dip below $3,800 recently. Some analysts are pointing the finger at a large sell order from a Maximum Extractable Value (MEV) trading firm called Symbolic Capital Partners.

Symbolic Capital Partners’ Sell Order

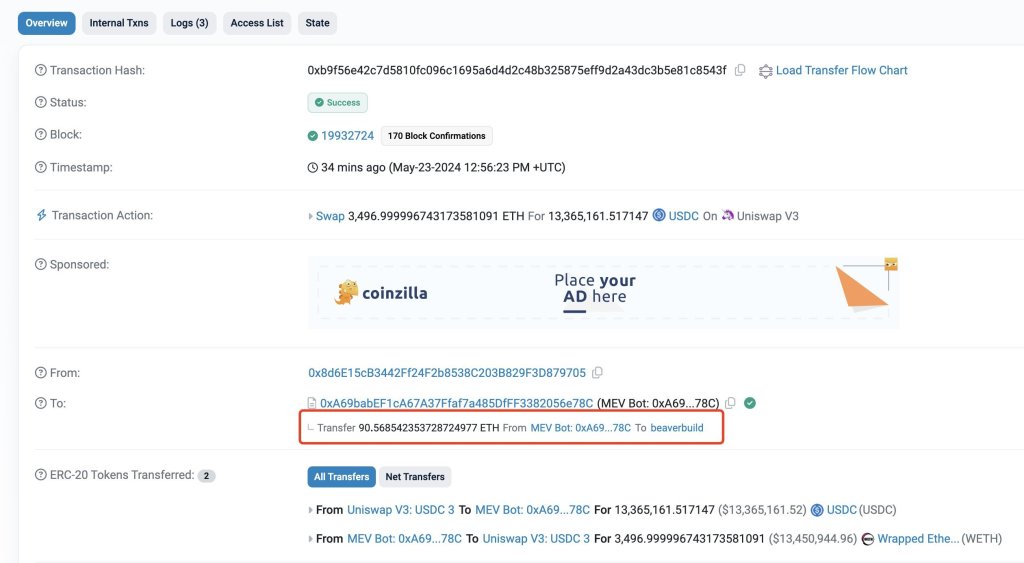

According to a crypto journalist, Symbolic Capital Partners sold off a huge chunk of ETH (6,968 ETH) worth over $27 million in just one minute. One of these transactions involved selling 3,497 ETH at once, with a hefty “bribe fee” of 90 ETH.

Impact on Prices

This massive sell-off appears to have triggered the volatility in Ethereum’s price. The exact motive behind the sale is still unknown, but it certainly had an impact.

Technical Analysis

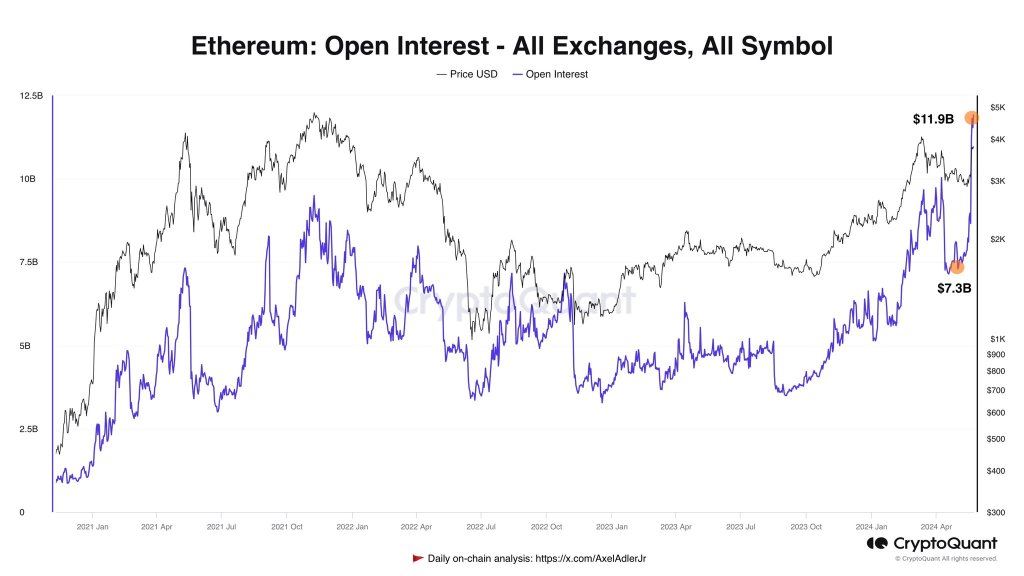

Despite the dip, Ethereum remains in an uptrend as long as it stays above $3,700. Open interest in Ethereum futures has also been rising, indicating traders’ confidence in its future prospects.

Spot ETH ETF Hype

The excitement around Ethereum is partly due to the potential approval of spot exchange-traded funds (ETFs). The SEC has been in talks with potential issuers, but there are concerns about ETH staking. Some analysts argue that if spot Ethereum ETFs allow staking, it could hurt the network’s decentralization.