Ethereum is back on the rise, climbing above $3,000 after dipping below $2,800 recently. This recovery has traders feeling optimistic, and breaking through $3,200 could be a game-changer.

Two Million Addresses in the Green

According to IntoTheBlock, if Ethereum surpasses $3,200, it’ll be a big win for traders. Around two million people who bought ETH at this price will finally be in the money. This means they can either sell and break even or hold on, hoping for even bigger gains.

$3,300: The Key Resistance Level

While Ethereum is showing signs of strength, it still faces resistance at $3,300. Breaking through this level, ideally with strong trading volume, could set the stage for further gains, potentially pushing the price towards $3,700 and then $3,900.

However, if sellers regain control and push the price back below $2,800, it could signal a continuation of the downward trend. This could lead to new multi-week lows, potentially even dropping to $2,500.

Spot ETFs and Whale Accumulation

Analysts are bullish on Ethereum, with the upcoming launch of spot Ethereum ETFs being a major factor. Just like spot Bitcoin ETFs opened the door for institutional investment in Bitcoin, similar inflows are expected for ETH. This could drive the price even higher, potentially breaking $4,100 and setting new highs for 2024.

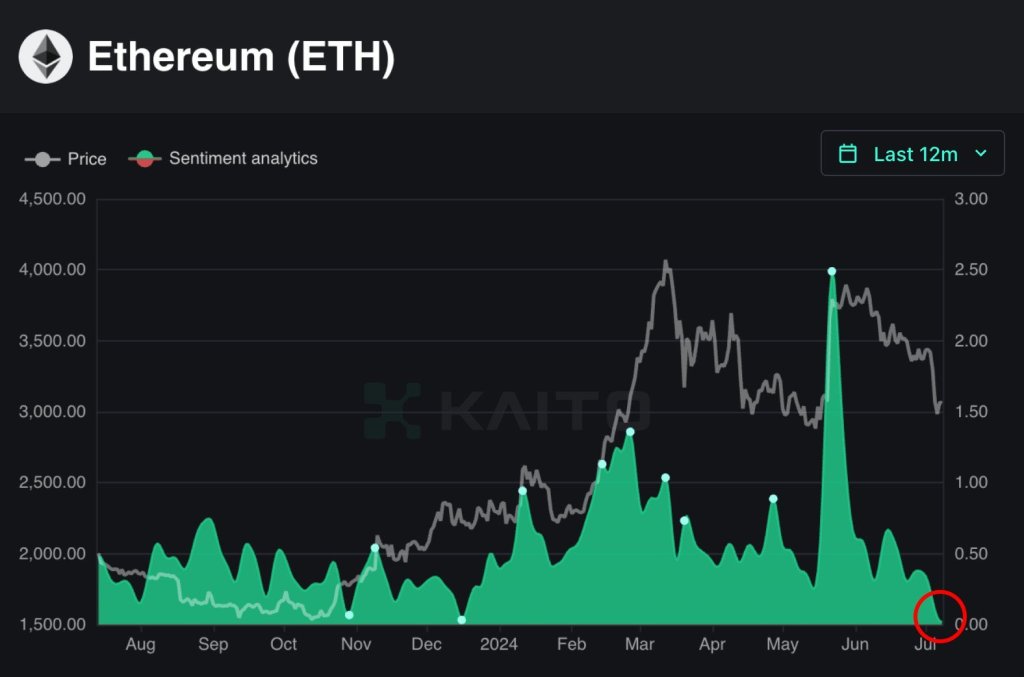

Despite this optimism, on-chain data suggests that traders are still cautious. Bullish sentiment is at a one-year low, and more ETH is being moved off exchanges, indicating that whales are accumulating. This suggests that investors are preparing for a potential surge in price.

Ethereum’s Scarcity

The amount of ETH held on exchanges, including Binance and Coinbase, is currently at 10.17% of the total supply. Another 28% of the supply is staked, meaning it’s locked up and unavailable for trading. This scarcity is likely to contribute to Ethereum’s price growth in the long run.